Your Complete Guide | How to import from China to USA?

Import from China to USA is a common practice in USA today as an alternative to local sourcing. Both countries are rivals but have the most business between them also. In 2018, the United States imported $639.7 billion in goods from China, accounting for 16.4% of its total imports.

Importing goods from China is a complex process and one that involves a fair bit of knowledge. The only way to handle importing goods from China is to use a professional service with experience and expertise. This guide will look into different aspects of the import process and highlight the problems you need to be aware of.

- Things you should know Before Importing from China to USA?

- What steps to follow before importing from China to USA?

- What are the top imports from China to USA?

- What factors to consider before importing from China to USA?

- What Shipping methods can you use to Import from China to USA?

- Available Incoterms while importing from China to USA.

- Costs for Importing from China to USA.

- Do I Need a Permit to Import from China?

- Door to door and Express shipping methods from China to USA.

- What Papers do I need to Import from China to USA?

- Do I need a Customs Broker to Import from China to USA?

- What are Custom Bonds, And Do you need custom bonds to import from China to USA?

- How much is the Import duties from china to USA?

- Winsky Freight– your best companion to import from China to USA

1. Things you should know Before Importing from China to USA?

There is no one-size-fits-all answer to this question, as the Permits and Licensing process in USA to Import goods from China will vary depending on the type and value of the goods being imported, as well as the country of origin.

However, all imported goods must be declared to US Customs and Border Protection (CBP). Here we have added the link to the requirement for being an importer according to the CBP guide in USA.

More information on the Permits and Licensing process in USA to Import goods from China can be found on the CBP website.

The permit and licensing process in the USA to import goods from China can vary depending on the imported goods. For example, if you are importing food products, you will need to obtain a permit from the US Food and Drug Administration.

If you are importing weapons or ammunition, you must get a license from the US Bureau of Firearms, and Explosives. The process for importing other types of goods from China may vary depending on the specific product and the agency that regulates it.

The China Section 301 Tariffs

Before importing from China to USA, you should understand the import tax from China to USA.

The China Section 301 tariffs were imposed on August 23, 2018, and are a tax of 10 percent on $200 billion of Chinese imports. The tariffs are in response to China’s unfair trade practices, including the forced transfer of American technology and intellectual property.

The China tariffs are having a significant impact on American businesses and consumers. Many businesses have had to raise prices or lay off workers. And consumers are paying more for a wide range of products, from electronics to clothing.

The China tariffs are just one part of the Trump administration’s trade policy. The administration has also imposed tariffs on imported steel and aluminum and is currently engaged in a trade war with China.

The Trump administration is justified in taking a tough stance on trade with China. China has taken advantage of the United States for too long, and something needs to be done to level the playing field.

But the China tariffs are not the best way to achieve that goal. They are causing significant harm to American businesses and consumers and are unlikely to change China’s behavior. That impacted the USA business significantly in 2020.

After the Trump Government fell, the new USA Government changed the sections and excluded some products from the section.

In addition, the U.S., in an effort to resolve trade disputes with China, has published several lists of items that won’t be affected by the new tariffs. You can view the updated list of tariff exclusions here.

2. What steps to follow before importing from China to USA?

1)Select Products to Import

Finding cheap goods to import from China is highly effective if you’re starting a brand-new business or expanding one that doesn’t yet offer much product variety. You’ll likely find better prices and higher quality items at wholesale rates.

Even if you’ve got something specific in mind, consider whether you’d rather focus on high volume or low margin. For example, if you’re planning on importing jeans, you might decide to go for quantity over quality. On the other hand, if you’re hoping to sell shoes, you might opt for a higher price tag so you can increase profit margins.

We will tell you to consider the followings:

- The product must have sufficient demand in the market.

- The product should not have any special law to import from China to USA.

- DO NOT import seasonal products if you are just starting.

- The product should have a 25% to 50% profit margin.

- The product is reliable, and you can provide a warranty if needed.

- The product should need low warehousing, few Maintainance, and storage.

Find a Good Supplier

There are a few key things to look for when trying to find a good supplier in China:

- Make sure the supplier is located in China. There are a lot of scammers out there who claim to be based in China but are actually located in other countries.

- Try to find a supplier that has been in business for at least a few years. This shows that they are likely to be more stable and trustworthy.

- Get in touch with the supplier and ask them lots of questions. A good supplier will be happy to answer all of your questions and will provide you with all the information you need.

- Ask for references from the supplier. If the supplier has credentials, they will provide you with their references.

- Once you have found a supplier you are happy with, be sure to sign a contract with them. This will help protect you in case there are any problems with the product or service they provide.

Do not forget to talk about the following when you find a new supplier:

- Product sample options

- Packaging

- Payment terms

- Lead times

- Quality standards

- Material specifications

- Shipping Terms

2)Find Freight Forwarder

You have to find a good freight forwarder in China if you want to increase your profit margin. Here are some pieces of advice from us:

- You should find a freight forwarder in China responsible for the shipment of your goods from China to your final destination.

- A freight forwarder in China is essential for the smooth shipping of your goods and should be selected after thorough research and consideration.

- You should look for online reviews and ask your friends and other importers who have shipped goods through a freight forwarder in China.

- You should ensure that the freight forwarder has a strong presence in China as many foreign companies are trying to establish a strong presence in China but are not successful.

3) Clear your Shipment in the USA

Customs Clearance is the most important part of any importation from China. If you do not provide the correct Documentation and Follow the Right Procedures, the customs will confiscate your goods, and you may end up paying extra charges.

You can take the help of a customs broker or freight forwarder who provides customs-related services. For example, in Winsky freight, you will get total customs clearance support for DDP shipping from China to USA.

4) Receive your Goods

Once your goods have passed through customs and all payments have been made, they must either go back into storage or be delivered to their intended destinations.

When shipping via air freight, if your cargo was loaded into containers, you should receive an invoice detailing the number of containers involved and where they were sent. For LCL (Less Than a Container) shipments, you’ll receive a bill of lading stating where you’re headed and how much weight is being shipped.

You may also receive a copy of a manifest describing each item included in your shipment.

3. What are the top imports from China to USA?

- Computers and electronic products – $140 billion

- Clothing and textile – $84 billion

- Machinery and equipment – $59 billion

- Toys and games – $24 billion

- Furniture and bedding – $20 billion

(U.S. Census Bureau – 2018)

The trade war initiated by the Trump Government has changed the scenario, but more or less, these are the top imports that the USA imports from China.

4. What factors to consider before importing from China to USA?

When you’re attempting to import from China, it is vital to know the pricing before, which can help save a lot of money. The specific brands are significant in the case of certain products. It is recommended to compare the prices of different brands by looking at each spec.

The cost of importing products is known as the cost of transportation. This is the price of shipping and its delivery to the final destination. It is also recommended to compare the delivery times of different companies before you make a decision.

If a company has a short delivery time, it means that it takes fewer days to get the product. Of course, this means that the cost of shipping is lower. It is also necessary to consider other aspects of the shipping method such as insurance and custom clearance.

Your overall objective of importing goods from China has to be clear. It is often noticed that people go after low prices, and this is the biggest mistake one can make. The product cost is not the real cost but the business’s total cost.

You have to take into consideration the other costs that emerge in the course of shipping and making money on the product. To begin with, the cost to import from China to USA is not very low. This can be worked around by choosing a close port as your shipping point.

In addition, you have to bear import duties taxes and charges from China to USA. The product should be in huge demand in the USA. You can use Alibaba to find out the potential of the product. Do not make the mistake of going too cheap or too expensive. Find a balance between the needs and wants of the customer.

Finally, doesn’t matter which incoterm you choose, which supplier you use, DO NOT use their own freight forwarder. You should find your own freight forwarder.

5. What Shipping methods can you use to Import from China to USA?

A few shipping methods are available to import from China to USA. These include air freight, and sea freight.

Air Freight

Air freight from China to USA is a process that involves a lot of coordination and planning. There are many different variables that need to be taken into account. For example, the type of goods being shipped, the weight and volume of the goods, the route the goods will take, and the timeline for the shipment. You also need to learn how the air shipping chargeable weight system works.

Air freight is generally faster and more expensive than other shipping methods, but it is often the best option for time-sensitive shipments.

When shipping from China to USA, it is important to work with a reputable and experienced freight forwarder who can help you navigate the process and ensure that your shipment arrives on time and within budget.

In most cases, air freights take 6-10 days.

Sea Freight

There are many benefits to sea shipping from China to USA. For one, it is a very cost-effective option. It is also a very reliable form of transportation, as ships are able to travel in all kinds of weather conditions. Additionally, sea shipping from China to USA is a very safe option, as there are many security measures in place to protect both the ship and its cargo.

LCL shipping is a great option for those looking to ship large quantities of goods or to ship items that are not time-sensitive. LCL shipping is a great option for those who are looking to ship goods from China to the USA. This type of shipping is less expensive than air shipping and allows you to ship more goods at a time.

Winsky is famous for its LCL shipping services around the world, especially in the USA. We offer a very competitive rate and handle your goods with expert hands. Do you have anything to ship and want to use LCL shipping method?

Ask for a quotation from us, and you will see the difference.

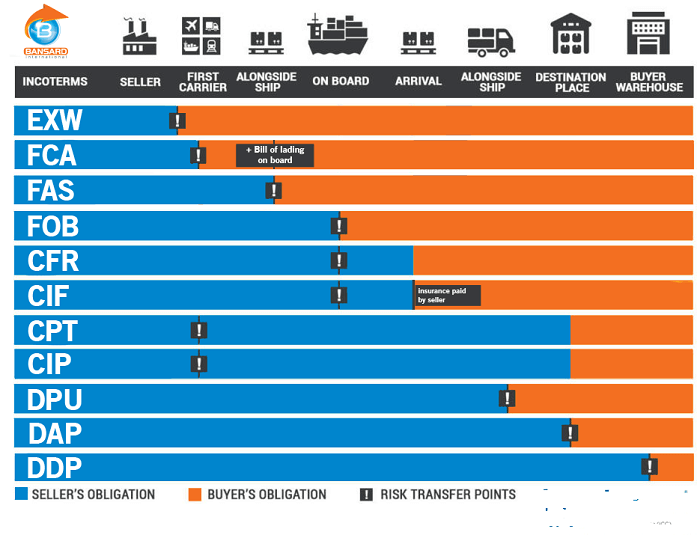

6. Available Incoterms while importing from China to USA

When importing from China to the USA, there are a few available Incoterms that can be used to make the process as smooth as possible. Here at Winsky Freight, we have a lot of experience with these sorts of things, and we thought it might be helpful to share some of that knowledge with our readers.

The most common Incoterms that are used when importing from China to the USA are FOB (Free on Board), CFR (Cost and Freight), and CIF (Cost, Insurance, and Freight).

FOB: This is the most common Incoterm used when importing from China to the USA. Here the importer takes more responsibilities than the seller.

CFR: Here seller takes the most responsibilities. You will take the charge when your goods arrive in the USA.

CIF: It is Similar to the CFR with the addition of Insurance.

These are just a few of the Incoterms that can be used when importing from China to the USA. If you have any questions about which Incoterm would be best for your particular shipment, please don’t hesitate to contact us. We’re always happy to help!

7. Costs for Importing from China to USA

Here is the breakdown of those costs when you import from China to USA. .

Transportation costs: You can use air, sea any shipping method. The cost will depend on the shipping method and incoterm between you and your supplier.

Here is the breakdown of the prices:

| Shipping method | The weight you should not cross | Price per KG |

|---|---|---|

| Air Freight | 80 – 300 KG | USD 5 – USD 7 |

| Sea Freight | 300 KG+ | Less than USD 1 |

Port Fees, Warehousing, and Inspection Costs: Products imported from China may be subject to customs inspection when entering the United States. These inspections can lead to additional charges being levied against your import duties. Furthermore, you could be charged for any fees incurred during an inspection. You may also face fines if you fail to pay the applicable fees.

Customs Broker Fees: Customs brokers will make the customs procedure easier for you. But they are not free of charge. You have to pay a decent amount if you use any licensed customs broker in the USA.

Import Duties: There are taxes and charges from China to USA. This is an important part of the importation process that must be considered, especially given the Section 301 tariffs earlier in the chapter. Duties from China to USA can often be a major cost. Many products are assessed duty based upon the value of the product being imported.

8. Do I Need a Permit to Import from China?

You do not need a permit to import goods to the US if the value is below the duty-free limits. If the total declared value is below USD 800, you will not require any form of permit. If it is above $800 and you plan to bring it into the USA you will need to fill in a CBP form HS-7 Declaration form. This should be attached to your shipment.

But for some individual categories, you MUST take permits from the respective authority. They are:

- Food and Drug Administration (FDA) – for Food, Housewares, cosmetics, medication, etc.

- Department of Transportation (DOT) – For cars and motor vehicles.

- S Department of Agriculture (USDA) – For any plants, animals, wood, etc.

- Tobacco Trade and Tax Bureau (TTB) – This department regulates Alchohol and Tobacco items.

- Environmental Protection Agency (EPA) – For any chemicals imported to the USA from China or any other country in the world.

- Federal Trade Commission (FTC) – They deal with a variety of parts, including labeling and others.

9. Door to door and Express shipping methods from China to USA.

Door to Door

Door to door shipping from China to USA is an excellent way to get your products delivered to your customers in a timely and efficient manner. By using a door to door shipping service, you can be assured that your products will be delivered to your customer’s doorsteps in a matter of days, if not hours. This is a much faster and more convenient option than using a traditional shipping service, which can often take weeks or even months to deliver your products.

Express Shipping

Express Shipping is best for low weight shipping. The best part is you will recieve your goods in under 3 days. But the price is high, and if you ship more than 150 Kg, it won’t be a cost-effective approach.

There are many options available for express shipping from China to the. FedEx, DHL, UPS are some of the top companies. All of these companies offer reliable service and can get your shipment to its destination quickly and safely.

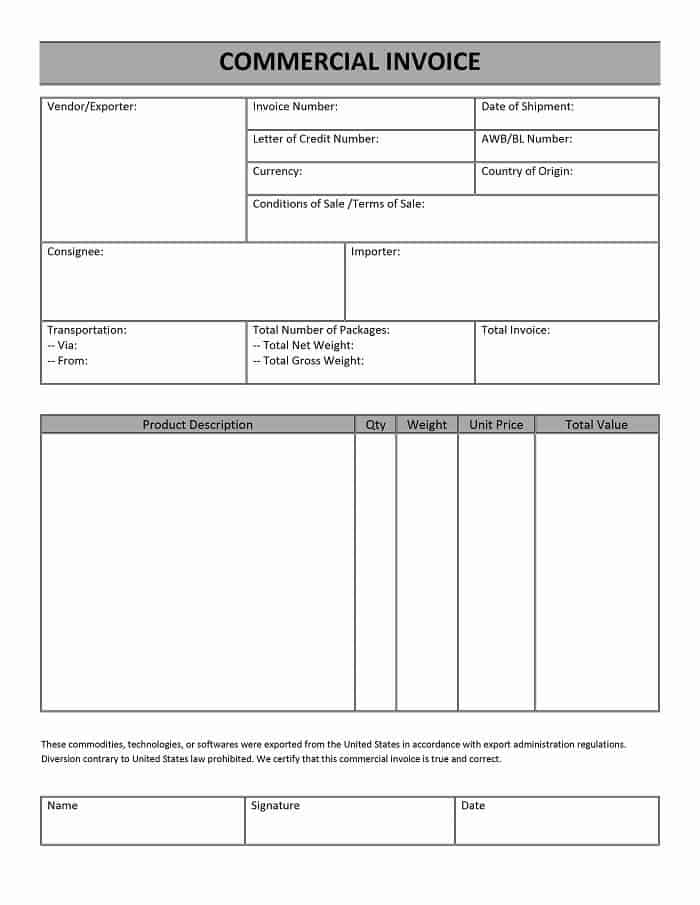

10. What Papers do I need to Import from China to USA?

You will need the following documents when you import from China to USA:

- Bill of lading/Airway Bill.

- Commercial invoice

- Letter of credit

- Packing list

- Certificate of origin

- Import declaration form for Customs

11. Do I need a Customs Broker to Import from China to USA?

There is no definitive answer, as it depends on various factors such as the type and value of the goods being imported, the frequency of shipments, and the importing company’s familiarity with customs regulations. But as an expert in this field, we will suggest you take support from an expert customs broker.

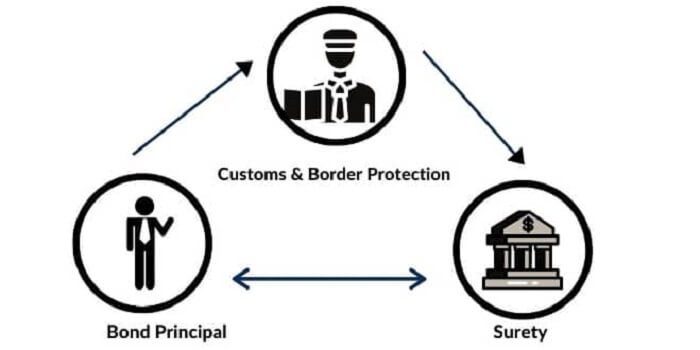

12. What are Custom Bonds, And Do you need custom bonds to import from China to USA?

A customs bond is an agreement between you (the principal) and a surety company. It guarantees that the importer complies with customs regulations and that Customs is paid for applicable import duty, tax, fine, and penalty.

You will need to show the customs bond if you import from China to USA. You can download the customs bond from the CBP website.

13. How much is the Import duties from china to USA?

When you’re ordering goods from China to be delivered to the United States, you may have to pay import duties, taxes, and other charges. These additional charges are calculated based on the value of the goods being shipped and can be either a percentage or a flat fee.

The United States imposes tariffs (customs duties) on imported goods. The duty is levied at the time of import and is paid by the importer of record. Customs duties vary by country of origin and product.

Most goods imported into the United States from China will fall under HTS subheadings 9903.88.01 (statuettes and other ornamental articles of china), 7009.92.00 (coated or plated with precious metal), or 7018.10.60 (lampwork beads).

In addition to customs duties, importers of record must also pay taxes on the imported goods, including federal excise taxes. The rates for excise taxes are published in the Internal Revenue Code.

The Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) impose a tax on imported pesticides. The tax rate is 1.75% of the value of the imported pesticides.

The Harbor Maintenance Tax (HMT) is a tax on the value of goods imported by water. The tax rate is 0.125% of the value of the imported goods.

The Merchandise Processing Fee (MPF) is a fee assessed on all imported goods. The fee is 0.3464% of the value of the imported goods.

In addition to customs duties, taxes, and fees, record importers must also pay applicable charges for inspecting, handling, and transporting the imported goods. These charges are typically paid to the freight forwarder or customs broker.

The United States-Chile Free Trade Agreement (USCFTA) eliminates duties on goods that meet the origin requirements of the agreement.

14. Winsky – your best companion to import from China to USA

Winsky freight is one of the oldest freight forwarders in China. We have been shipping to USA for over a decade. We offer a very affordable rate that most freight forwarders won’t be able to do. Besides, our experience of operating in the industry will ensure a smooth freight forwarding experience.

We have a dedicated team for USA. Also, we have a dedicated support team, and you can contact us 24/7 for any suggestions.

Conclusion

We hope you enjoyed our article on How to import from China to USA. We know this is a very popular topic, and we hope you found some useful information in this guide. We are always excited when one of our posts can provide useful information on a topic like this! If you have any questions about importing from China, do not hesitate to contact us – Thank you for reading.

Leave A Comment