Importing from China | A Complete FAQs Guide

According to the China Statistical Yearbook for the year 2015, China had 2,801,143 factories and is the largest exporter of goods worldwide. China is literally called the “factory of the World” or “the World’s Factory.”

If you own a small retail shop, large business branches, or a wholesale business and looking to find ways how to select & import that product from China, then you have come to the right place.

In this blog, we will cover everything like choosing the best products, finding the best manufacturers, doing packaging, customs clearance, and transportation details. Plus, we will discuss all the famous shipping terms. So, keep reading if you want to learn more.

- How to Import from China in 7 Easy Steps?

- Which is the Most Profitable Product to Import from China?

- What are the Best Websites to Buy Wholesale from China?

- Can I Import Directly from China?

- How much does Import from China Cost?

- How Do I Find a Reliable China Freight Forwarder?

- What Are the Most Famous Incoterms®?

- Pro Tips for Importing from China

1. How to Import from China in 7 Easy Steps?

Step no 1) Select Products

If it’s your first time buying from China and selling it at your place, then you do need to draw a whole pros & cons plan for the new products. You see China as the “Factory of the World” and has millions of products to choose from. Chinese manufacturers of everything from as small as a toothbrush to as large as Industrial Shredders. But it does not mean you can buy anything and get a profit from it.

There are 3-simple Rules to select the products;

- It must have a 30% ~ 50% profit margin.

- It must have a history of Consistent Demand.

- Low care is required during shipment and storage. ( no air conditioning, etc. )

And one more thing to remember, make sure it is not banned in your country, or customs will confiscate it right away.

If you already have a successful business setup and then you can go with your chosen product right away because you know its market better than anyone else.

Step no 2) Find Chinese Wholesale Suppliers

After you are done deciding the products you are gonna need and what features you want, then you can go looking for wholesale suppliers. Now, when you are searching, you will find 2-kinds of suppliers;

- Traders

- Manufacturers

| Traders | Manufacturers | |

|---|---|---|

| How They Work | Do not make their own products; buy from other manufacturers. | Make their own Products. |

| Pros |

✓ MOQ is very Low. ✓ Large Variety of Product Designs. ✓ Have Stocked Products so Fast Shipping is Available. |

✓ Low Prices.

✓ Long-term Direct Warranty. ✓ Freshly manufactured Products with the latest designs. ✓ 100% Customization: You can control Material, Design, and Production, etc. |

| Cons | X High Prices.

X Less Warranty Period. X Customization is very little or none. X Chances of damaged products are more if products are stored for a longer period. |

✓ Higher MOQ ( Minimum Order Quantity ).

✓ Less Variety of Products. |

As you have read above, both suppliers have their own pros and cons. But the general rule of thumb is;

“ Contact factories first; if they can fulfil your requirements, then you don’t need to pay middle-man trading companies fees; they are the last resort.”

That being said, now back to the real question, how to find the suppliers? Well, it’s no piece of cake, but you can do it the following 6-ways;

i) Online: Find Supplier’s Websites Online

ii) Tradeshows: Visit the Tradeshows of your relevant Products

iii) Competitors Panel: Look at the Competitor Business Panel and see who is making their products

iv) Ask Your Supplier: If you are already sourcing from some supplier in China, ask them, they must know a lot of suppliers.

v) Online MarketPlaces: Websites like Alibaba, Aliexpress, DHgate, etc., are the sites where thousands, if not millions, of manufacturers, have listed their products. You can find your relevant manufacturer and contact them.

vi) Visit China: If you don’t trust online buying, then you can visit the “Yiwu” city of China, which also has the nickname China Commodity City. This city is flooded with traders who work closely with factories. You can ask them to introduce you. Plus, It has a Wholesale market that is open all around the year, unlike tradeshows, which open on special days.

Step no 3) Choose the Best Supplier

Once you have found the potential suppliers, now is the time to choose the best one for you, which you can do by messaging them with the following questions;

- Ask for their Price?

- Ask for their Minimum Order Quantity ( MOQ )?

- Send them your Product(s) Design; ask if they can make it?

Once you get the replies ( from 10 out of 30 messages ), sort out the ones which are best fitted according to your needs. Then, ask them again with these further questions;

- Lead times

- Sample Options

- Packaging Options

- Payment Terms & Methods

- Material & Production Description

- Quality Standards

- Shipping Options

Now, only a few suppliers will reply back. Arrange all of them in priority order, and you can buy a sample order from your first supplier. In case, if the first one doesn’t work, then move on to the second one, then the third, and so on, until you find the best.

Step no 4) Negotiate Prices

Before Doing Trail & Bulk orders, negotiate the price with your supplier. Fixed price is a myth when you are dealing with Chinese wholesalers.

The best way to get the best price is to contact a lot of suppliers, do a sample order and then tell them about your future plan. This way, they will know you are serious and give your lowest rates. Now, just choose the one with the best rate.

Please be aware the Best rate is not always the lowest. If someone is giving a very low rate than others, then they must be making bad-quality products. Don’t buy from them. Just choose the lowest one from the average rates range.

Then ask the best rate supplier for the complete information like raw materials to payment terms. Ask for more discounts; if he is not giving any, then at least discuss instalment plans, cheaper shipping methods, best packaging, warehouse storage, or any other benefits you can get from the supplier, which can save you money in the long term.

Step no 5) Purchase Products

Now when you are done with sample orders and negotiating the prices, it is time to place the order.

“To buy the products, you just have to pay the seller, just like you normally do in real life” this is what you must be thinking, but things are not this simple here.

For example, let’s say you pay the seller, but they do not deliver what they promise, don’t replace faulty pieces, late your deliveries, or even scam you after receiving the money. What will you do then? When you are buying from Online Suppliers, you are miles away, and the seller doesn’t come under your country’s laws.

But it does not mean you can’t buy from chinese suppliers; it’s just you have to set safeguards. When purchasing the products, follow the below rules;

- Sample Product: Always ask the seller for a sample product before bulk orders to check quality ( which we have already done in step 4 )

- Trail Order: Sample Products are hand chosen and do not always describe the final quality. It is best to do a 20% or less trial order of your total order quantity. You can test these trial products with real customers and get a practical review before moving to full-scale bulk orders.

- Legal Contract: If you like the product, draw a legal contract mentioning everything from raw material to warranty to promised shipping dates.

- Third-Party Inspection: Request a third-party inspection after production but before final shipment.

- Trusted Payment Method: The general rule of thumb is to pay 30% upfront and 70% before shipment after getting proof of production. But there are still chances that some suppliers may scam you after getting the advance payment; to avoid that, always choose a trusted payment method, like the LOC ( letter of Credit ) or Alibaba Trade Assurance, which will give you a refund in case of a scam.

- Check Supplier’s History: There is one more thing you can do when purchasing first time for a supplier is to check their history. A company with at least 7+ years of business history is not gonna run out of business or scam you. Plus, you can also get reviews from their previous client if you can.

Step no 6) Arrange Shipment

Most people think that your decision on shipment comes after the products are manufactured. No, it’s the other way around. As you already know, due to the coronavirus, the whole is going through a shipment crisis; the shipping prices are doubled or tripled, and the deliveries are getting delayed by months.

So, always contact a shipping company even before you contact the suppliers; this way, you can not only get rates but also get your shipment on time when the sales are at peak.

There are 3-shipping methods;

- Air

- Sea

- Train

- Express Delivery

| Air Shipping | Trian Freight | Sea Freight |

Express Delivery ( FedEx, DHL, etc. ) |

|

|---|---|---|---|---|

| Best Weight Limit | Up to 225 kg | Any weight | Start from 225 kg | Any Weight |

| Delivery Time | 1 ~ 10 days | 12 ~ 20 days | 22 ~ 43 days | 3 ~ 10 days |

| Cost | $5 ~ $10+ / kg | $2 ~ $3 / kg | Less than $1 / kg | $20 ~ $300+ / Kg |

Express Delivery Courier Services are way too costly and only best for small documents which you need to transport securely & fastly.

Air Shipping: When you are looking for sample & trail orders below 225 kg, then it is best to choose fast air shipping because you need to test the products as soon as possible and place the final bulk order so they can be produced before the sale season.

Train Freight: If you are looking for something cheaper than air shipping ( more than 50% cheaper ) but faster than the sea ( 50% faster) then train freight is the best option for you. China has recently invested in Train Silk Road from across Europe & Asia. Recently, china has connected its railway to London.

Sea Freight: At last, always chooses Sea freight for orders above 225 kg because it is way too cheap, less than $1 per kg, which is almost 5 to 10 times cheaper than air shipping. The only downside is the long delivery time of up to 50 days or more. But you can get your orders on time by planning ahead; shipping your products at least 3-months before you need them.

- FCL is an abbreviation for “full container load” in logistics. This means that importing goods from a single shipper has taken up the entire container. This is cheaper than LCL.

- LCL is an abbreviation for “less than Container-Load’ in logistics. When a single shipper’s importing products do not completely fill an entire container, then the LCL method is used, and one container is shared among two or more shippers.

Step no 7) Customs Clearance

When the order reaches your country port, you need to show them documents and pay customs charges; only then can you get your package.

But if you fail to comply with any import regulations like your supplier didn’t provide the right documents then your cargo will be confiscated for days, and you will have to pay extra charges. In the worst-case scenario, your cargo will be destroyed or resold at the auction. So, always prepare and check all documents beforehand.

The customs charges are different from country to country and will depend on the price, quantity, and type of your products. It is very difficult to calculate custom charges because they keep on changing. It is recommended to contact a licensed customs broker in your country to know the charges before shipment.

Besides that, every country has different demands for documents, but to give you an idea, the most basic ones are;

- Packing list

- Certificate of Origin

- A Letter of Credit (LC)

- A Bill of Lading or BOL/Airway bill

- Commercial invoice provided by the supplier

- Miscellaneous documents

In most countries, you don’t need a special license for import. But if your shipment is found suspicious or selected in the random examination, then it may get tested, your cargo will be delayed, and you will have to pay extra examination fees. The best way to avoid that is always to do well-labelled packing and submit fully prepared documents.

Once you have submitted all the documents and fees, you are free to move out your shipment from the port. Some sellers provide door-to-door delivery, while in other cases, you have to get the products from the port to your home at your own expense.

Please be aware to submit all the documents and pay fees on time because, after a certain time limit, the port will charge you additional charges for the storage of your goods.

2. Which is the Most Profitable Product to Import from China?

In 2021, China exported 3.36 trillion worth of goods, marking itself as the World’s Largest Exporter.

If you are looking to find out what products you can ship that will profit you the most, then you have a lot to choose from. To get an idea, let us see China’s Top 10 exports of 2022, which includes;

i) Electrical Machinery and Equipment = $804.5 billion

ii) Machinery ( including computers ) = $492.3 billion

iii) Lighting, Furniture, Signs, Beds, Prefabricated Buildings = $126.3 billion

iv) Plastics and Plastic products = $118.1 billion

v) Vehicles = $108.9 billion

vi) Toys and Games = $94 billion

vii) Optical and Medical apparatus = $88.8 billion

viii) Articles of steel or iron = $85.4 billion

ix) Clothing and accessories = $78.2 billion

x) Organic chemicals = $73 billion

As you can see that all of these products are highly in demand around the world but what products will give you more profits depends upon your area. For example, just survey every famous shop in our market and see which products are selling the most. That’s it; this is your ideal product which will sell fast and give you good profits.

But, before buying the products, you must consider the things that are banned by the Chinese Government for export to other countries in order to save your money and avoid lawsuits. The prohibited and restricted items include;

|

Prohibited Products ( Can never be Shipped ) |

Restricted Products ( Needs Special Permissions ) |

|---|---|

|

|

3. What are the Best Websites to Buy Wholesale from China?

According to a report, China has more than 3 million factories ( that’s a lot ), and it is nearly possible to visit all of them in person and select the best one for yourself. However, you can do that by searching them on Online Marketplaces, where thousands of sellers have their pages.

The famous Wholesale Online Marketplaces include;

- Alibaba

- Aliexpress

- DHgate

- Banggood

- Made-in-China

- Global Sources

- 1688.com ( Subsidiary of Alibaba )

- Taobao ( Owned by the same group as Alibaba )

- Chinavasion

- Chinabrands

- Niche Dropshipping

- Chinagoods

- YiwuGo

- SHEIN

- Light in the box

- Zaful

- CJDropshipping

- TBdress

- Tomtop

- Yaaku

The websites at the top of this list are the most trusted, with verified suppliers and refund policies. While websites at the bottom are still in their young stage and involve risks. If you are new, then Alibaba is the best place to start because it has a Tradeassurance payment method which will give you refunds in case of any shipment or quality faults.

Why Is Importing From China so Cheap?

Low Labour Cost: Second, China has the largest population in the world (1.4 billion people), enabling them to employ workers at low pay rates.

Excellent Supply Chain: Some Chinese factories make raw materials and parts while other factories buy raw materials from them at cheap costs and make finished goods. This well-established supply chain allows for cheaper production costs.

Cheap Transport: Chinese government has built ports, roads, and rail track networks all over China and also around the world, enabling manufacturers to ship the products at lower costs than any other nation.

Latest Technology: Chinese factory owners are technology-oriented and use the latest machinery for more fast & efficient production of goods which results in cheaper production costs.

Government Help: Chinese government helps its exporters in many ways, such as the establishment of special trading zones, tax relaxation, export insurance, exchange rate management, duty drawbacks, etc.

4. Can I Import Directly from China?

Yes, you can import directly from china; you don’t need to;

- Be Chinese

- Live in China

- Chinese Relations

So, technically there is no need for a broker, but to avoid getting into the trouble of completing the paperwork, you can find a reliable broker who will take care of all the below documentation and saves you time & money, such as;

- Product-Specified License: if you are importing sensitive items like drugs, foods, or medical machinery, then you will need to apply for a Product-Specified license from the Chinese government.

- Business License: if you want to ease the process then you need to set up an import company in china which will need a special business license.

- Export License: Once you get a business license, you will need to get an export license for your company.

- Custom Documentation: Packing list, Certificate of Origin, Letter of Credit (LC), A Bill of Lading or BOL/Airway bill, Customs Bond, Commercial invoice provided by the supplier, and other Miscellaneous documents.

Once you submit the documentation, you will need to pay 3-types of taxes to the Chinese Government;

- VAT ( Value-Added Tax)

- Consumption Tax ( On items: Motor Vehicle Accessories, Jewelry, Cosmetics, High energy-using products, etc. )

- Export Custom Duties

Besides that, when you receive the products at your country port, you will need to pay import duties to your country.

Some people ask if they can avoid customs duties, but it is not possible if your country requires so. But there are conditions when you don’t need to pay customs duties, such as;

- If you live in Hong Kong, Singapore, or Macao, then you are very lucky because these countries have the lowest import tariffs ( 0.00% on some products ).

- Every Country has a price limit from which duties start, and if your products are below it, you don’t need to pay any duties. Such as, for the US, this applies when the total cost of the imported goods exceeds $800, which is known as the De Minimis Value. If they cost less than $800, they are exempt from import tax (exempted from alcohol or tobacco).

5. How much does Import from China Cost?

a) Buying Products

It is obvious that the first-ever money you will pay is for the products you buy from the seller. This product amount includes many small costs, such as;

- Fix Products Price

- Third-Party Quality Check ( if any )

- Packing

This price is also the major factor in determining the overall costs, so if you control it, you can earn big profits, and the best ways to do it is;

- Ask the seller for Installments

- Avoid customization if it’s not free

- Use Lightweight Packing Materials; maybe even use one

- Try to trim down unnecessary features from your products

- Always negotiate with the seller about the price if your order is big

- Always Buy in Bulk ( more products you buy, the lower the price will be per unit )

- More.

b) Moving Charges to the Seller’s Country Port

The next charges you gonna pay are for shifting the products from the seller’s warehouse to the port, which include;

- Loading Charges

- Transportation Charges

If you choose FOB (Free on board ) or other payment terms in which the seller is obligated to move the order to the port, then you don’t need to pay for these. But these costs are not much, and it takes about USD $500 to move a 20ft Container from the seller’s destination to the port.

However, the seller has many local contacts through which they can load & move the order safely & cheaply. But if you try to move on your own, then it will probably cost you more. So, it is recommended to choose a payment term that includes shipment to the seller’s country port at least.

c) Main Shipment Charges to Buyer Country Port

“Main Shipment is from Seller Country Port to the Buyer Country Port.”

In September of 2021, the shipment charges were like $10,000+ ( sea freight ) for a 40-foot container, but now the prices fall as low as $2000 for some destinations. There is a decrease of more than 80% in costs in shipment in 2023.

Freight has a deep impact on the overall cost of products after their purchase price. And the cost of freight depends on many factors, such as;

- Route of Shipment

- Insurance of Shipment

- Means of Shipment ( Air, Sea, Land, & Train )

- Deal of Shipment ( FCL Vs. LCL )

- Season of Shipment ( Peak seasons have more prices due to an increase in demand )

- Shipment Company

Technically we can’t control the insurance because it is recommended to do it as much more as possible because every year, hundreds of containers get lost or damaged.

But we can reduce the prices by;

- Planning delivery 2 ~ 3 months earlier than peak season

- Selecting a Medium size company because its prices will probably be lower due to high competition.

- Choosing Sea freight because it is the cheapest mode of transportation than air, land, & train freight.

- FCL Vs. LCL: In Sea & Train Freight, FCL ( Full Container Load ) is a much cheaper deal than LCL ( less than container load ). So, if you have enough products, go for FCL.

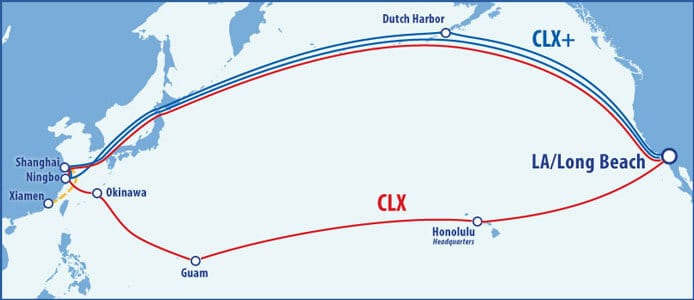

- Route of Shipment: The last thing which determines the shipment price a lot is the route you decide. For example, from China to the USA, there are 2 main routes, one goes through dutch Harbor and the other pass by Honolulu.

d) Custom Duties & Fees Costs

It is a fact that 30% of shipment money ends up in paying Customs Duties at the buyer’s country port. And these costs will rise if you have missing documents and your order ends up in the port warehouse for more than the allowed days, in which case you have to pay extra fees for storage.

It is recommended to evaluate the Customs duties beforehand from your country’s customs brokers because it really has a big impact on overall product prices, and you may end up paying more than the sale price you will get.

But determining Customs costs is not so easy because it varies from;

- Product to Product

- Country to Country

- Time to Time

Most buyers end up trusting their sellers, who mostly have no idea about real custom duties because these duties are paid at the buyer’s country port, not at seller’s.

➔ Calculation of Duties:

So, the best way to determine the Import Duties is to find an HS code, which is;

“HS Code, also known as “Harmonized System Code” is a 6 ~ 10 digit code. These codes are internationally accepted codes, and they tell the exact category of your product.”

You can get this HS code from your buyer or read it from your Commercial invoice. Then tell it to your country’s customs department agent, and they will determine the duties by following criteria;

Please be aware the declared customs value of goods may not be the buying price; it depends on shipment terms; for example, if you choose FOB terms, the declared value of goods will be based on FOB, and if you choose CIF or any other, it will depend on that.

This estimation of Customs Duties before buying the products helps you in determining the exact Overall End Price of products, and if it is too near to the sale price ( lower profits ), then you can cut down;

- Some Features

- Choose a Cheaper Shipment means

- Ask for installments from the seller

- Decide on other Products

- More.

e) Warehouse & Transportation Charges to Buyer Address

The last factor which affects the final product price is storage & distribution, which mostly includes;

- Unloading the Order from the Container

- Loading it again on a train or vehicle to move it to the buyer’s address

- Moving Costs to Buyer address

- Storage charges at Warehouse ( if you don’t have yours )

- Distribution Costs

These expenses may seem small, but they can make a huge difference in your profits. Always keep these in mind if you don’t want to end up with losses.

And finally, some other factors which can affect your product’s final prices are;

- Import License Cost

- Changes in Fuel Prices

- Congestion Charges at Destination Port

- Random Testing Charges at the Destination Port

- Currency Inflation ( which directly affects Services & fuel )

- More.

6. How Do I Find a Reliable China Freight Forwarder?

If you are new in this business, then you must have heard a lot about freight forwarders. They perform the following duties as middle-man;

- Quality Inspection

- Loading

- Handles Shipments from China to Your Country

- Provides Warehousing

- Deal with Custom Clearance

- Even Sourcing of Products

- And other matters.

Unlike Brokers, they have no profit margins in products, but they do have flat fees. Freight Forwarders are like your representatives in China; they are not necessary, but having them helps a lot.

You can find Chinese Freight Forwarders in 2 ways;

a) By Searching Online

b) Manually from Trade Directories

a) By Searching Online

The best way to look for freight forwarders is to go to your pc and write “ Best 10 Freight Forwarders in China” and so on. You will get a list of many freight forwarders from which you can choose the right one for you.

b) Manually from Trade Directories

The second way is to get Trade Directories from Chinses Port Authorities and look for the freight forwarders which are at the top. This method is a little old-fashioned and requires a lot of legwork. Plus, it is updated after months. So, we don’t recommend using it.

➔ How to Choose the Best Freight Forwarder?

Choosing a reliable and lowest-rate freight forwarder is not an easy task; there are a lot of scammers & beginners in this business. So, to find the right one, look for the below green flags;

- Free Warehousing: Some freight forwards offers free warehousing at the origin country, which really helps in reducing the final price of import goods that, in return, give you more profits. So, if your freight forwarder is not giving you free warehousing, don’t hire them.

- Find Someone who Gives Insurances: Almost all freight forwarders out there have standard insurance package, but only some give you multiple insurance options which protects you against all losses & damages. So, always choose a company whose insurance plan gives your coverage to the last penny if any mishap happens.

- The more Experience, the Better; Always choose a company with 10+ years of experience because they would have shipped hundreds of orders and have known about every customs legal matter of most countries. Plus, always ask for their previous client’s history and try to contact them. Always ensure that your chosen freight forwarder has some experience with your product.

Why is China Shipping Expensive?

It is true that shipping was late & expensive in 2021 & most of 2022 due to Coronavirus Pandemic & Suez Canal incident. But that is no longer the case.

According to a report, as of December 2022, the prices of 40-foot containers fell 80% more than in September 2021. This fall in prices happens due to the following 2-reasons;

- In 2021, there was a shortage of containers. But now, the problem is the opposite; we have too many containers piling up at ports, taking up useful space. That’s why their prices are falling.

- The Second reason is cancelled shipments because the consumer market is losing its appetite, and the shipping companies are getting huge losses, so they are lowering their prices. Just like if a private bus has empty seats, it will offer cheap tickets.

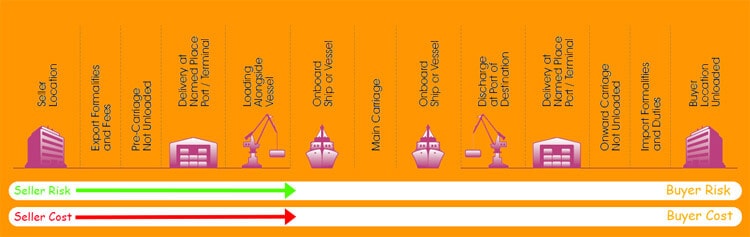

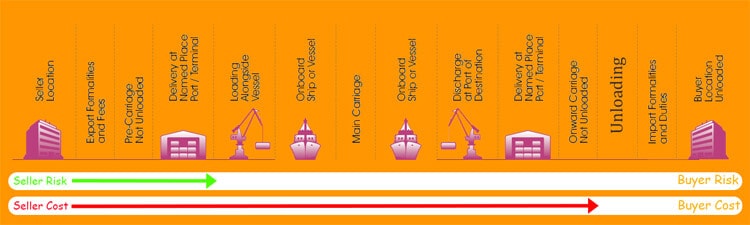

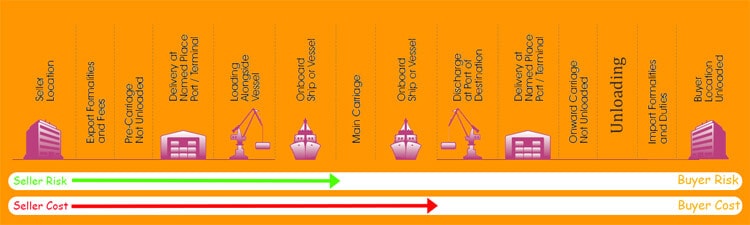

7. What Are the Most Famous Incoterms®?

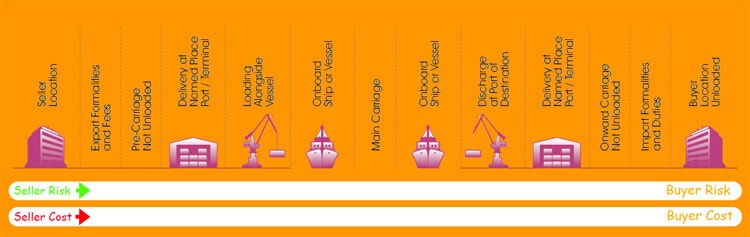

Incoterms®, also knwon as, “International Commercial Terms” are a set of 11 standard trade terms which are recognized globally. These 11 terms are created by the International Chamber of Commerce (ICC) to facilitate local and international B2B sales of goods.

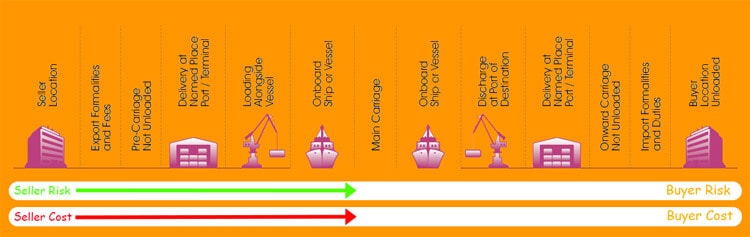

i) EXW – Ex Works

ii) FCA – Free Carrier

iii) FAS – Free Alongside Ship

iv) FOB – Free on Board

v) CNF / CFR – Cost and Freight

vi) CPT – Carriage Paid to

vii) CIP – Carriage and Insurance Paid To

viii) CIF – Cost, Insurance, and Freight

ix) DAP – Delivered at Place

x) DAT/DPU – Delivered at Place Unloaded

xi) DDP – Delivered Duty Paid

i) EXW – ( EX Works )

If you don’t want the seller to interfere in any matter, then choose this shipment term. In this arrangement, the seller is only responsible for giving you the packed products at his factory, and you will be responsible for moving the products to ports, doing customs clearances, and all other things.

ii) FCA – ( Free Carrier )

In this method, the seller is responsible for moving the products to a buyer-specified location which can be an airport, seaport, warehouse, or any other location. And until the products are delivered to the buyer’s specified location, the seller is responsible for all transportation costs and all losses.

Under FCA rules, the seller is responsible for export duty, taxes & customs clearance. FCA is applicable to all shipment methods. And under this rule, the seller is not obligated to unload the goods or load them onto a vessel.

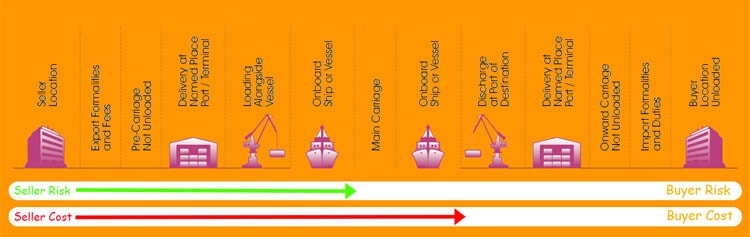

iii) FAS – ( Free Alongside Ship )

This term obligates the supplier to deliver the products within reach of the buyer’s ship, unload them, and customs clear them for export.

The buyer is responsible for reloading, ocean freight, insurance, and all other expenses. The risk is moved to the buyer when the products arrive at the specified place & time mentioned in the contract.

iv) FOB – ( Free On Board)

In this, the seller will be responsible for moving the goods to the port, loading them on the transport vehicle, and taking care of export customs clearance and port charges.

And the buyer will decide on the shipping method, routes, incoming custom clearance, and other expenses. This term only applies to sea shipment.

v) CNF / CFR – ( Cost and Freight )

The seller is obligated to clear the goods for export, deliver them to the ship at the port of departure, and cover the cost of transporting the goods to the designated port of destination under CFR terms (short for “Cost and Freight”).

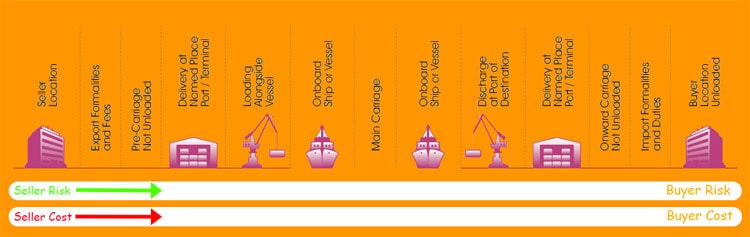

vi) CPT – ( Carriage Paid To)

In this method, the seller will prepare the goods, get them to a shipping port, select a carrier ( air, sea, train, etc. ), and then transport the goods to the seller’s destination port. In this method, the seller is responsible for all export documentation & fees as well as transportation fees ( until it reaches the specified destination port/place ).

But once it reaches the first carrier ( a shipment company or a person ), the buyer will be responsible for any loss.

So, it is best for the buyer to insure the products. CPT is similar to CIF, but the only difference is CPT works for all shipment modes like Air, Sea, Train, and Road, while CIF only works for maritime.

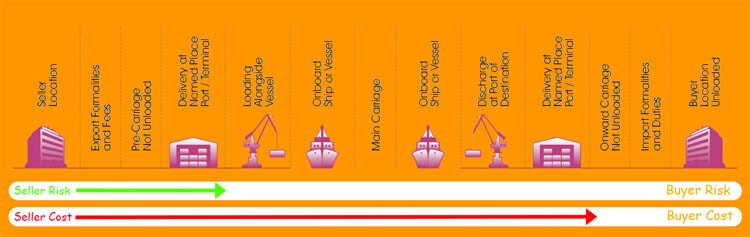

vii) CIP – ( Carriage and Insurance Paid To )

This arrangement indicates that the seller is responsible for freight costs as well as insurance. The risk of loss or damage will be transferred to the buyer as soon as it reaches the first carrier at the origin country port.

But the seller will be responsible for all risk insurance coverage until the shipment reaches the buyer’s destination port.

viii) CIF – ( Cost, Insurance, Freight )

In this, the seller is also responsible for everything until the products arrive at the buyer’s country destination port. It means that the seller will move the product from the factory to the port, load them on the carrier, take care of port charges, export customs clearance, and decide on carrier and shipping routes.

The seller is responsible until they are loaded on the shipping vessel. And the buyer will be responsible for import customs clearance and other charges. CIF is different from CNF in that in CIF seller pays for insurance until it reaches the destination port, while in CNF, no insurance fees are paid.

ix) DAP – ( Delivered at Place )

DAP is very similar to CPT, but it is way safer. You see, in both of these, the seller is responsible for shipping costs until the products arrive at the buyer’s destination port.

But in CPT, the risk is transferred to the buyer as soon as the package is transferred to the first carrier ( at the seller’s destination country ), while in DAP, the seller is responsible for goods until they arrive at the mentioned destination ( in the buyer country port ).

In this method, the seller is obligated to prepare export documents and pay for export duties, & transportation costs until it reaches the destination.

x) DPU – ( Delivered at Place Unloaded )

DPU is the next level to DAP; if you have noticed, DAP covers all costs, documents, & costs until they reach the buyer’s destination; It does not deal with unloading the products at the buyer’s destination. But in DPU, the seller is also responsible for unloading the products from arriving transportation and giving them to the buyer.

xi) DDP – ( Delivered Duty Paid )

In this method, the seller is responsible for transporting the goods to the buyer’s destination port or premises. Plus, the seller will take care of import duties & clearance in addition to export customs duties. However, under this rule, the seller is not responsible for unloading the goods at the buyer’s destination place.

The seller is at more risk with this method because he has to pay late fees, bribery costs, and other expenses at his own risk if any problem happens.

8. Pro Tips for importing from China

Working with a Chinese Supplier gives a lot of profits, but it is not so easy. There are many scammers out there who may either run when you give them money or give you bad-quality products. But not all suppliers are bad; most of them are honest. You can follow the below pro tips for secure dealing;

- Always ask for samples and then do a small trial order to ensure quality.

- Never send full payment in advance. Only transfer 30% advance and 70% after proof of full production.

- Consider paying small fees to freight forwarders if you want to save transportation & custom clearance time & fees.

- Make sure that your products are heavily insured against all kinds of damage & loss until they are unloaded at your address.

- To avoid loss of package during transit or detention at customs, triple-check that all documents are present and on the packings, all shipping marks are labeled correctly.

- Never order your products in peak season because they will reach you at the end of the sale season, and you will end up at a loss. Always plan 3-months ahead for production & Shipment.

- Always try to use compact & lightweight packing because shipping size & weight both matters a lot. For example, in a 40-foot container, you can either put ten assembled chairs or up to 30 unassembled chairs ( tightly packed ).

- If you are working with a supplier for the first time, don’t use unsafe Payment methods like Paypal, Western Union, and similar ones because they have no refund policy. Always use a Letter of Credit or Alibaba trade insurance method for the first time.

- When you have held the seller responsible for Shipment, then they will probably choose a bad shipment carrier to save money, and your products may get damaged. In that case, make sure that the seller is responsible for the risks or that you have insured your order.

- Always ask for a third-party inspection before Shipment to get proof of the quality & quantity of your order. And please note that the Third-Party Inspection team will only look for what you have asked them; they will not look for defects on their own. So, always mention even the smallest requirements which you want.

Conclusion:

Hopefully, after reading this article, you must become aware of all the steps of choosing a wholesale supplier from china and how to import. As a first-time importer, we know that you must have tons of questions about international trade, and no doubt you will encounter many unexpected hurdles.

Well, beginner’s fear is natural, but don’t let it become stop you from earning more profits and becoming successful. As we told you earlier, having a freight forwarder eases the process; saves you hundreds of dollars and months.

“We, Winsky Freight®, one of the best freight forwarders from China, would like to help you if you give us a chance. If you are stuck in finding a good supplier or having problems with the shipment, send us a message for free advice.”

Leave A Comment