How to sell on Amazon Canada

There is great news for sellers looking to expand into a new Amazon marketplace—try Amazon Canada!

Amazon Canada is the perfect entry point into the North American market without the tough competition found on Amazon.com. The Canadian e-commerce sector generated over 65.5 billion USD in revenue in 2024, with Amazon Canada responsible for over 40% of that share. Now is the time to get a slice of this huge market if you can figure out the ropes.

This guide will explain the various costs involved in selling on Amazon Canada, the process of setting up your Amazon.ca account, fulfillment options, and tell you the hot-selling products on Amazon Canada right now. Let’s dive in.

What Is Amazon Canada?

Amazon Canada is Amazon’s official online store for Canadian customers. It was launched in 2002 and can be accessed through the site Amazon.ca. It is true that Amazon Canada functions similarly to all other Amazon stores you are familiar with, such as Amazon US. Nevertheless, before selling in this marketplace, you should be aware of certain requirements.

Why Sell on Amazon Canada?

There’s lots of opportunities for new and existing sellers to tap into on Amazon Canada. Let’s explore some of them:

- Access to a Growing E-commerce Market: Your products are exposed to a large and willing audience of buyers.

- Canada’s leading Marketplace: We already mentioned that Amazon is the most visited online retail platform in Canada, with millions of unique visitors every month. It’s a fresh market for your brand to expand into.

- Lower Competition: When compared to Amazon.com, Amazon.ca has fewer sellers to compete with. This means you can rank higher and gain more views and conversions for the same products on Amazon Canada.

- Diversifying revenue at reduced risk: One thing you should never do as an online seller is place all your eggs in one basket, because you lose everything when something goes wrong. Selling on Amazon Canada introduces you to a new market and increases your sources of revenue.

- Low entry barrier: If you already sell on Amazon US, then it is very easy to enter the Canadian market. This is because Amazon has now provided the North American Unified Account for you to sell in the Canadian market with the same seller account. There’s several cultural similarities and interests between the US and Canada, so you won’t find it difficult to break in. Just replicate your efforts and processes and you get great results.

- Amazon extras available: Amazon’s Fulfillment by Amazon (FBA) services and Amazon prime are also available to Canadian sellers. You can take advantage of these perks to simplify your logistics and shipping services.

- Global Reach: Selling in a big country like Canada increases your reputation and gives you an international standing that makes your customers recognize your brand more.

What are the Costs Of Selling On Amazon CA?

Selling on Amazon Canada involves several fees that vary based on your chosen selling plan, product categories, and fulfillment methods. You have to frequently check Amazon Canada seller central page to update yourself with current prices. The basic costs you should expect to pay are:

1. Selling Plan Subscription: They depend on the selling plan you choose:

- Individual Selling Plan: Amazon charges CAD $1.49 per item sold. It works well for sellers with low to average sales volumes.

- Professional Selling Plan: It requires a monthly subscription fee of CAD $29.99, no matter the number of items you sell.

2. Referral Fees: Amazon receives a commission for every item you sell on their platform. This is called the referral fee. It is a percentage of the total price of your goods, usually 15% for most goods. Please note that these seller fees are different from the selling plan fees.

3. Fulfillment Fees: You have two fulfillment options: Fulfillment by Merchant (FBM) and Fulfillment by Amazon (FBA).

- Fulfillment by Merchant (FBM): You handle storage, packing, and shipping by yourself, therefore these costs totally depend on you.

- Fulfillment by Amazon (FBA): You ask Amazon to manage storage, packing, and shipping for you at a fee. FBA fees depend on product size, weight, and category.

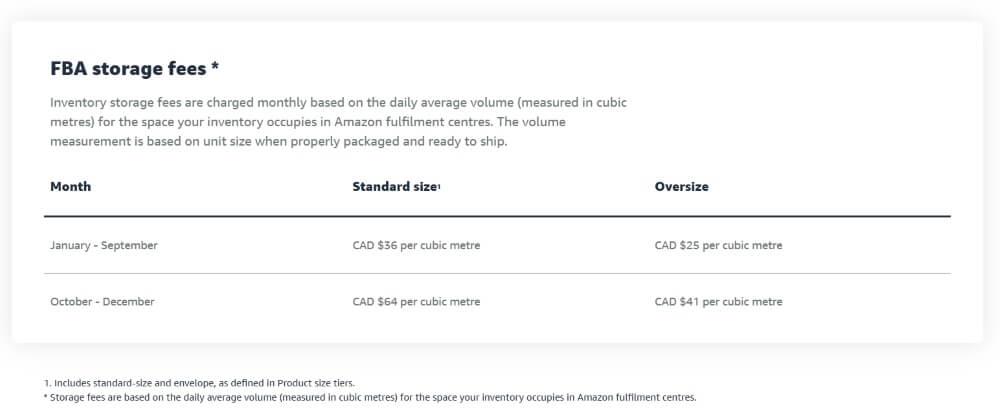

Note: If you choose Amazon FBA, then you pay Fulfillment fees and storage fees. The fulfillment fee covers the fee per unit of picking and packing your orders, shipping and handling, customer service, and product returns. Since February 5, 2024, goods that cost less than CAD $11 will automatically receive Low-Price FBA rates with the same delivery speeds as standard FBA. Low-Price FBA rates are CAD $0.55 less than standard FBA rates.

Aside from the fulfillment fee, you’ll also pay a monthly storage fee for inventory stored in Amazon’s fulfillment warehouses. From January to September, standard-size items incur a fee of approximately CAD $36 per cubic meter (CAD $1.02 per cubic foot). During peak season (October to December), fees rise to CAD $64 per cubic meter. Finally, if your inventory spends longer than 271-365 days in Amazon’s warehouse, you’ll be charged an aged inventory surcharge of CAD $262 per cubic meter.

Do I have to pay Taxes as an Amazon Canada Seller?

Yes, you do have to pay taxes when selling on Amazon.ca. The good news is that Canada runs a simplified tax system that’s easy to keep up with. The three sales taxes that apply in Canada are: the Goods and Services Tax (GST), the Harmonized Sales Tax (HST), and Provincial Sales Tax (PST).

Federal Sales Tax or Goods and Services Tax (GST)

The GST is a federal value-added tax levied at a rate of 5% on most goods and services across Canada. GST is collected by the Canada Revenue Agency (CRA) and applies uniformly in all provinces and territories. Whether you pay this tax depends on the province your business operates. This tax is usually charged on businesses registered in Canada, but you may still be liable for it even if you’re not registered in Canada.

Provincial Sales Tax (PST)

Every Canadian province handles their tax filings in their own way, which gives rise to the PST. PST is a retail sales tax imposed by individual provinces. It may also be called Quebec sales tax (QST) or retail sales tax (RST). Different provinces charge different rates, and PST is collected separately from the federal GST. Provinces that charge the PST are British Columbia, Manitoba, Saskatchewan, and Quebec.

Harmonized Sales Tax (HST)

The HST combines the federal GST with the provincial sales tax to create an harmonized rate. Ontario, Nova Scotia, New Brunswick, Prince Edward Island, Newfoundland and Labrador are the provinces that charge HST. They all charge 15% except for Ontario that charges 13%.

As you can see from the table below, Alberta and the territories (Northwest Territories, Nunavut, and Yukon) use GST only.

| Province/Territory | GST | PST | HST | Total Tax Rate |

|---|---|---|---|---|

| Alberta | 5% | 0 | – | 5% |

| British Columbia | 5% | 7% | – | 12% |

| Manitoba | 5% | 7% | – | 12% |

| New Brunswick | – | – | 15% | 15% |

| Newfoundland and Labrador | – | – | 15% | 15% |

| Northwest Territories | 5% | 0 | – | 5% |

| Nova Scotia | – | – | 15% | 15% |

| Nunavut | 5% | 0 | – | 5% |

| Ontario | – | – | 13% | 13% |

| Prince Edward Island | – | – | 15% | 15% |

| Quebec | 5% | 9.975% | – | 14.975% |

| Saskatchewan | 5% | 6% | – | 11% |

| Yukon | 5% | 0 | – | 5% |

Table showing a summary of Sales Tax Rates by Province and Territory

Note: A dash (-) indicates that the specific tax is not applicable in that province or territory. Please consult a tax professional for complete information.

How To Sell on Amazon Canada?

1. Choose a Selling Plan on Amazon.ca

Selling on Amazon Canada follows a similar process with Amazon registration in other marketplaces. You can choose between the Individual plan and the Professional plan. You know already that Amazon charges a $1.49 CDN fee per sale on the individual plan and a flat $29.99 CDN per month on the professional plan.

Winsky recommends that you choose the individual plan if you’re new to Amazon, or you plan to sell less than 25-30 items monthly. The individual plan helps low-volume sellers manage costs and keep inventory low. If things change in your business, you can always switch to the professional plan.

If you’re a pro seller on Amazon with high-volume sales > 30 items monthly, then choose the professional plan. The professional plan also gives you access to special Amazon programs like Amazon Business, Launchpad, etc.

North America Unified Account

This is one interesting benefit many sellers don’t take advantage on Amazon.ca. If you already have an Amazon seller central account in the US or Mexico, then you don’t need to create a new one when expanding into Canada. For $39.99 USD, you can sell in these three marketplaces with just one seller account. However, you’ll need to relist your products on Amazon Canada.

On your seller Central page, click on your business name and select the marketplace you want from the drop down. Note that Individual Plan sellers only have access to the US and Canada stores under the Unified account. If you’re on the professional plan, then you have access to the U.S., Canada, Mexico, and even Brazil stores.

2. Set up a Canadian Amazon Seller Account

Now, you can sign up for a new account on sell.amazon.ca. You’ll need the following details to complete your account registration:

- Bank account number and bank routing number

- A chargeable credit card

- Your government issued national ID

- Tax information

- Phone number

- Business email address

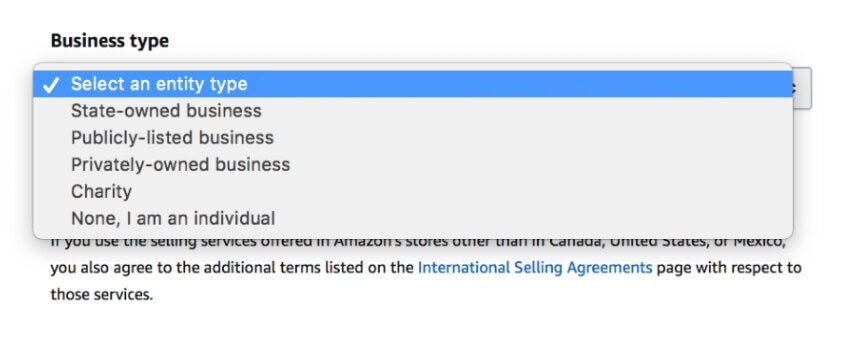

Then create an account with your email, and state your business location, even if you don’t reside in Canada. Under Business Type, you can select “None, I am an individual” if none of the other categories applies to you.

Following this, you fill in details of your physical address, bank information, DOB, store name, etc. When completed, wait for Amazon to verify your account. Once you’re approved, it’s time to start selling!

3. Find a Reliable Supplier

You now have an account and know what to sell, next up is finding a reliable supplier that can fulfill your inventory. A bad or inconsistent supplier translates to bad business for you. It is no news that China is the largest market for product suppliers in the world. If you’re confused on where to get started, try the popular Chinese marketplace Alibaba.

With Alibaba, you can customize products and sell them under your own brand. We’ve simplified the steps of finding the best Alibaba supplier in this article. You can also consider dropshipping options on other marketplaces like Walmart, eBay, and AliExpress.

4. List Your Products

Your next step is to list your products on your Amazon page for customers to see. The more attractive your product page is to customers, the higher your potential sales. You’ll need to provide detailed product titles, descriptions, bullet points, and high-quality images of the products you plan to sell. You’ll have to provide product identifiers like GTIN, UPC, ISBN, or EAN where necessary. Please pay attention to relevant keywords in your product descriptions to increase your visibility.

If you already sell products in the US, then listing them on Amazon Canada is very easy. You simply transfer your product listings from your Amazon.com US store to Amazon.ca. All your product information and reviews will be automatically transferred to your new Canada store. When putting in prices, remember to account for the difference in exchange rates between the US and Canada. Because of differences in taxes and selling fees in both countries, it’s usually better to check how other competitors are priced before setting your price.

5. Choose a fulfilment method

We’ve briefly discussed this earlier, but let’s explain in a bit more detail. You have two fulfilment options on Amazon Canada: Handle fulfilment yourself- Fulfillment by Merchant (FBM) or let Amazon handle it for you- Fulfillment by Amazon (FBA).

Fulfillment by Amazon (FBA)

Here’s how FBA works in simple terms: You ship your products to Amazon Canada fulfilment centres, and from there, Amazon handles storage, packaging, shipping, customer service, and returns whenever you have an order. Using FBA comes at a percentage fee of your product price, but it comes with numerous benefits too.

One big benefit of FBA is that it saves you so much logistics stress. You can always sit in the comfort of your home and have Amazon manage every aspect of your order, right down to returns and customer service! Another big benefit is that FBA orders are eligible for prime shipping. This means prime members can get your products in 1-2 days after ordering, which makes you gain more customers.

If you consider using FBA, you must be willing to strictly follow Amazon’s product packaging requirements to avoid fines or rejected shipments.

Fulfillment by Merchant (FBM)

With FBM, you have complete control over the fulfillment process. You store, package, ship, and handle customer service yourself. If you’re a professional seller, you might get some savings choosing FBM because you avoid FBA fees. The problem with FBM is that it’s more difficult and stressful to organize direct shipments to Canada customers without having a presence there. If you’re worried about this, you can use third-party freight forwarders with experience shipping to Canada, like Winsky Freight.

If you already have a steady and reliable logistics network or ship products that require special handling, then you might consider FBM. Otherwise, nothing beats the comfort FBA offers you, and we recommend it. Many successful sellers on Amazon Canada adopt a hybrid approach i.e. using FBA for best-selling items with predictable demand and FBM for products where FBA fees would greatly reduce profit margins.

Remote Fulfillment with FBA

This fulfilment method only applies to sellers that already have an Amazon seller account in the US. With Remote fulfilment, you can directly use your existing inventory in the USA to fulfill your Canada, Mexico, and Brazil orders. Amazon will handle your taxes and duties for you and include it on the buyer’s checkout price. Your products will still be eligible for prime shipping, but this takes longer to deliver in Canada (7 to 12 days).

If you’re just testing out the Canadian marketplace before expanding fully, then this is a great option for you because you don’t have to ship or store goods in Canada. But remember, your products will take longer to deliver which will affect your profit margins. We advise sellers to switch to FBA Canada or use a 3PL once they’re fully ready to sell in the Canada marketplace.

Shipping to Amazon FBA in Canada

Your goods can reach Canada by air or sea. If you’re shipping to Amazon FBA fulfillment center, Winsky Freight uses the DDP service. One of the biggest advantages of using a reputable freight forwarder like Winsky Freight is that we understand all the requirements for shipping to Amazon FBA. Therefore we help you package your goods to Amazon’s standard and ensure compliance. Here are the two routes we offer under DDP:

Air freight

Our Air freight DDP service to Canada is fast and competitively priced. Expect your goods to reach the Canada FBA warehouse in 10-12 days. We ship your goods from anywhere in China directly to Canada. Then Express couriers like FedEx complete the door-to-door delivery at the Amazon warehouse. Since it’s DDP shipping, we also handle customs clearance and all duties involved. You simply have to wait to be notified when delivery is made.

Sea freight

If you’re not in a hurry with delivery, you can choose our sea freight DDP option. Your goods reach the Canada FBA warehouse is 35-40 days. You can choose between our LCL option where your products share container space with other importers; or our FCL option where your only your products are shipped in a container. Once your products land at the port, we clear them on your behalf, then ship them to the FBA warehouse using express couriers like DHL, UPS, or FedEx.

Note: To avoid incurring long-term storage fees at the Amazon warehouse, we advise you to calculate and plan your inventory ahead. If you already sell on Amazon.com, remember that Amazon Canada is a smaller market than Amazon US, so your goods may not move as quickly. So, don’t judge your Amazon.ca inventory with your Amazon.com inventory. Start small and expand as you grow.

Top Product Categories to Sell on Amazon Canada

As you would expect, some products are more popular in the Canadian marketplace than in other international markets. Based on current market trends, here are a list of products you can build your business around-

- Home and kitchen products like kitchen appliances, home organizers, bedding, and home décor are in consistent demand. Humidifiers, air purifiers, and seasonal items related to weather are also hot-selling products.

- Electronics and tech accessories like smartphones, tablets, laptops, smart home devices, headphones, streaming devices, etc. Canadians are tech-savvy and willing to invest in quality electronic products.

- Health and fitness related items like vitamins, supplements, fitness equipment, personal hygiene items, and wellness goods continue to see increasing demand. Canadian consumers value these products more when they’re organic and natural, and they’re willing to pay more for products with sustainable packaging.

- Sports and outdoor equipment like camping gear, hiking equipment, winter sports accessories, and fitness products.

- Beauty and personal care products like skincare, haircare, and cosmetics continue to show strong sales performance.

- Baby products like diapers, baby food, clothing, toys, and baby safety equipment. Pet products are also very big in the Canadian market.

- Books and educational media like cookbooks, planners, calendars, and digital media.

- Clothing and fashion accessories, such as winter coats, thermal wear, waterproof footwear, and layering pieces, sell well in the Canadian market.

- Handcrafted and artisanal goods across apparel, home décor, vintage items, and kitchen wares.

Winsky’s Tips for shipping and selling on Amazon Canada

Follow our top tips for an excellent selling experience on Amazon.ca-

- Optimize your labeling and packaging to meet Amazon Canada’s requirements and avoid fines. Your products must have both English and French labels to comply with Canadian bilingual regulations. Make sure the packaging materials used are strong to withstand extreme temperatures and protect your products during transit. If you use Winsky, we’ll cover these for you.

- Make your product detail page appealing: Use the right keywords, images, titles, and descriptions to improve your page ranking and visibility on Amazon.

- Use Amazon FBA: There’s so many benefits you get by allowing Amazon to handle fulfillment on your behalf. Even though it comes at a cost, we recommend it for sellers looking to expand into Amazon Canada.

- Plan your inventory ahead: Always schedule your shipments 4-6 weeks in advance of peak seasons like winter holidays, Chinese Holidays, and Back-to-School periods. We also advise that you send less inventory to the Canada FBA center until you’re sure how much products you need monthly.

- Use DDP services, and take advantage of consolidation: Always use DDP terms when shipping to Amazon FBA, because it saves you lots of stress. To reduce costs, we can help you combine multiple shipments into one container.

- Quality over price: When selecting products to sell on Amazon Canada, consider that Canadian consumers prioritize quality over price. They make research before buying and value detailed product descriptions, honest reviews, and clear sizing information. Make your product detail page very appealing to consumers.

- Ship smaller products: Focus on product categories that have favourable weight-to-value ratios to reduce shipping costs. For example, beauty products, tech accessories, and smaller home products may give you better profit when you remove the shipping expenses from China to Canadian fulfillment centers.

- Go sustainable!: As part of the increasing interest in the environment, Canadians love natural and eco-friendly products with sustainable packaging. Include this in your brand messaging and watch your sales grow.

FAQs

Can You Sell on Amazon.ca if You Live in a Different Country?

Yes, you can sell on Amazon Canada even if you live in a different country. Just follow the Amazon.ca sign up process and that’s all. You can ship your products to Amazon FBA Canada warehouse and manage your products remotely from your seller central account.

Will I need to pay taxes in Canada?

Yes, you need to pay taxes in Canada. How much you pay depends on the province your business operates from. Check the table provided in the article to understand the tax percentages for each province.

Conclusion

And that’s it. Now, you know how to sell on Amazon Canada. There are millions of buyers waiting for you on Amazon.ca, so go on and start selling now. If you need help with shipping to Amazon Canada FBA, contact Winsky Freight today. We’ll comprehensively manage your entire logistics and package your goods according to Amazon standards. We look forward to hearing from you.

Leave A Comment