What are the Documents needed for Import Customs Clearance?

When importing goods into a country, you’ll need various documents essential for customs clearance. These documents are crucial to ensuring compliance and avoiding delays with the customs process. Wrong documentation can also result in fines, seizure of your goods, or legal trouble.

In this guide, Winsky has provided a detailed list of necessary import customs clearance documents and explained their importance to ensure you have a swift clearance experience.

Key Players in Import Customs Clearance

Before we take a look at the essential documents, you should first understand the significant people involved in import customs clearance:

Importer: The importer is responsible for bringing goods into the country. They ensure that the interests are adequately documented and that all applicable duties and taxes are paid.

Customs Broker: The customs broker is a licensed professional authorized to represent the importer in customs matters. They are experts in customs procedures and can handle the preparation and submission of the necessary documents and the payment of customs duties. Therefore, they’re like a bridge between importers and customs authorities in the importing country.

Freight forwarder: The freight forwarder is a shipping professional specializing in arranging transportation goods. They can help the importer choose the most efficient and cost-effective shipping method and handle the customs clearance process on their behalf.

Customs Authorities: These are the government agencies overseeing imports and exports.

What is the Import Customs Clearance Procedure?

Import customs clearance follows a specific process. If you adhere to the clearance regulations, your experience should be smooth. The procedures may vary depending on the country, but the general process is as follows:

- Verify your HS code classification and ensure your cargo is permitted in the importing country.

- Accurately prepare and submit all required documents to customs. You can ask your freight forwarder or customs broker for help to avoid making errors.

- Customs reviews the documentation and determines the applicable. Customs authorities may also decide to physically examine the goods to verify their accuracy and compliance with regulations.

- Pay the applicable customs duties and taxes.

- Your goods are cleared for entry after customs approval and payment.

Essential Documents for Import Customs Clearance

Customs clearance requires several documents, and the specific ones you need depend on the importing country and the type of your goods. Here are the significant documents to get ready when preparing for import customs clearance:

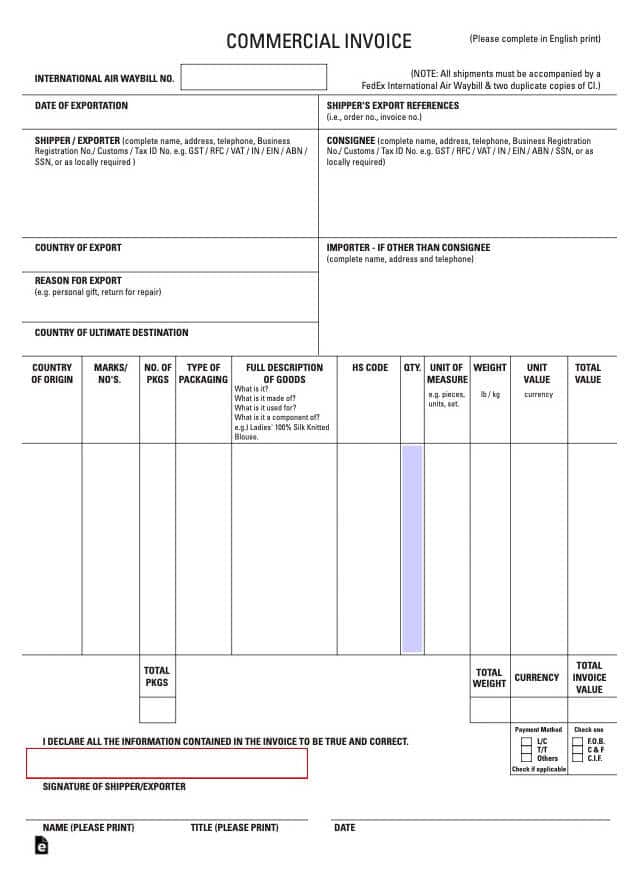

Commercial Invoice

The commercial invoice is one of the most important documents when importing goods to another country. It serves as a bill for the goods shipped and shows the Value of the goods, the HS code, and the terms of sale (e.g., FOB, CIF). The commercial invoice must be accurate and filled out in the language of the importing country.

This document helps customs authorities evaluate the Value of the imported goods to calculate the tax and customs duties an importer will pay. They also use it to verify the accuracy of other documents.

A standard commercial invoice will contain the following information:

- Names and addresses of the supplier, exporter, and importer

- Country of Origin and date of issue

- Invoice number

- Detailed goods description (Use specific descriptions of the goods. Avoid using general terms like “clothes” or “electronics.”)

- Quantity and total Value of goods

- Total invoice value and payment currency

- Payment terms (how and when to pay, including any discounts)

- Shipping incoterm used and mode of shipping

- Type of packaging used

You are free to use the template provided by your freight forwarder or arrange your commercial invoice however you like. Just ensure it includes all the details customs officials need to determine whether the items you are importing are allowed to enter the country.

Bill of Entry

The Bill of Entry (BOE) is an essential legal document showing the total Value of payments made for imported cargo. The BOE can be filed before the arrival of goods or within 30 days after goods’ arrival.

You should complete the BOE by the importing country’s laws, and it should provide a detailed declaration of the imported goods, including their classification, Value, and origin. Like with the Commercial Invoice, customs authorities rely on the BOE to calculate the correct amount of customs duties and taxes owed for the imported goods.

Transport Documents

The two essential transport documents for import clearance are the Bill of lading (BOL) and the Air Waybill (AWB). These documents perform the same function. However, BOL is meant for goods shipped by ocean freight, while AWB is for goods sent by air freight.

Bill of Lading (BOL)

The Bill of Lading (BOL) is a title document issued by the shipping carrier as proof of receipt of your goods on the ship and an acknowledgment to deliver the goods to your destination address. The BOL proves your ownership of the shipped goods and allows you to claim them from the shipping company at the destination port.

A standard bill of lading contains details about the cargo, including incoterms, date, destination port, type and quantity of goods, and condition of the received goods. A BOL also provides a tracking number to monitor your shipment during transit. In case of any damage or loss, the BOL is one of the documents you need to file for compensation.

The BOL usually accompanies the goods during shipping and must be signed by a representative of the shipper, shipping carrier, and recipient of the goods. Without the BOL, you’ll not be able to claim your goods at the destination port.

Air Waybill (AWB)

The Air Waybill is equivalent to the Bill of Lading but is explicitly used for airfreight. It is a title document that shows the contract between the airline carrier and the shipper.

You need the AWB to claim your cargo delivery at the airport, and you may choose to use one waybill for different cargo shipments. The air waybill also helps you track and monitor the status of your shipments during shipping. The AWB follows a standard format the International Air Transport Association (IATA) provides.

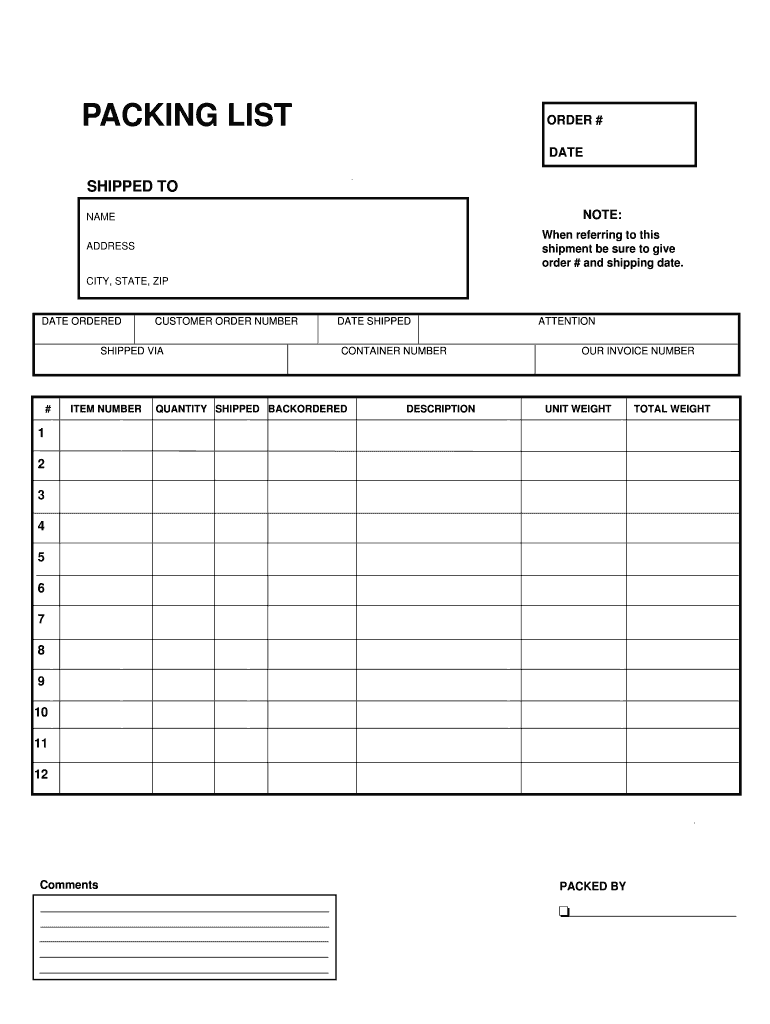

Packing List

The packing list is a document that provides a detailed breakdown of what’s inside each package in a shipment. It tells you the number of items in each box, the content of the package, their weight, size, and date of issue. It outlines how the goods were packed and arranged as agreed between the buyer and seller.

It would help if you understood that the packing list goes along with the commercial invoice and BOL and should contain similar information. The packing list is required by customs authorities to match information described in other documents during import clearance.

However, the packing list is different from the commercial invoice. It’s only there to confirm the cargo’s details and specify the type of packaging used, whether it’s a box, crate, drum, or carton.

Your freight forwarder can help you provide a standard packing list. Like the commercial invoice, there’s no particular template to use as long as you include all necessary information.

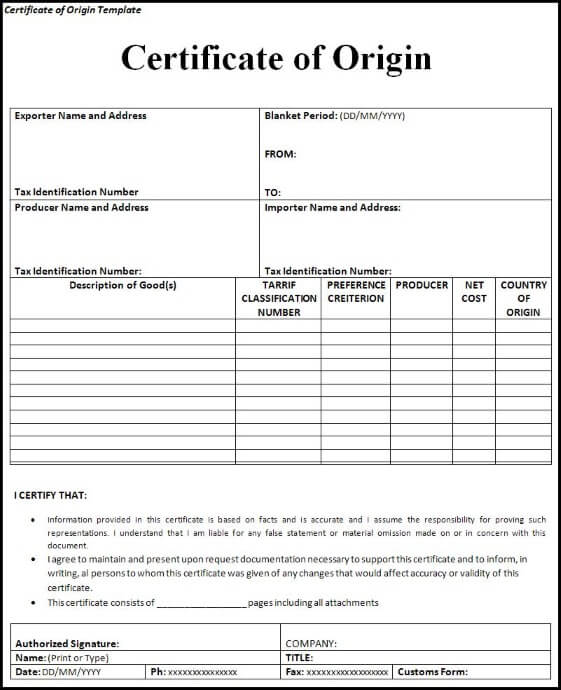

Certificate of Origin

The certificate of origin specifies the country where the goods were produced. The document contains information about the product, destination, and the exporting country. It is required to determine applicable duty rates and eligibility for preferential trade agreements.

Import duties can vary based on government policies and trade agreements between countries. Some countries offer benefits like reduced taxes on goods from certain countries. Having the Certificate of Origin helps customs to know if you’re eligible for such uses.

Import Licenses and Permits

Certain goods may require special import licenses, depending on their nature and the importing country’s regulations. Please obtain these documents to avoid customs delays, fines, or even the rejection of your shipment.

Import licenses are essential for specific products that the government highly regulates. Generally, goods like firearms, plants/animals, military items, drugs, chemicals, etc., require an import license.

When you want to import such regulated items, you must apply for a license granting you legal permission. Customs officials will require this document for processing when your goods arrive.

Insurance Certificate

The Insurance certificate provides evidence of insurance coverage for your goods during transit. Customs authorities use it to determine if the selling price of the cargo includes insurance.

While customs clearance might not always be required, having an insurance certificate is brilliant because it can be used to claim compensation if something goes wrong with your shipment. It protects your goods against potential losses like theft, damage, or accidents.

You only need to present the insurance certificate for customs clearance if the installation needs to be already covered in the commercial invoice.

Letter of Credit

In international trade, a letter of credit guarantees payment from the buyer to the seller. It contains all the payment terms agreed upon by both parties and ensures that the exporter will be paid if the contract terms are met. It is also an important document submitted during import clearance procedures.

Importer Security Filing (ISF) and Arrival notice (Specific to USA)

These documents are specific to shipments entering the United States.

The Importer Security Filing (ISF) provides early information about incoming cargo into the USA to enhance security and customs efficiency. It is usually used for ocean freight goods and must be submitted to Customs and Border Protection (CBP) at least 24 hours before the cargo sails from the last port of origin to the U.S.

The arrival notice is a document prepared by the shipping carrier to notify all involved parties about the shipment’s arrival in the USA. It usually contains information about the number of cargo units and a description of the goods. This document lets you know when your goods have arrived for clearance and pickup arrangements. The arrival notice is then used to apply for customs clearance in the USA.

All the above documents are necessary to ensure a smooth customs clearance process. Please comply with the specific regulations of the importing country to avoid delays and unnecessary fines during clearance.

We understand that you might need help keeping track of all the requirements and filing all your documents in order. This is why you need Winsky to help you make your customs clearance process hassle-free. Our team of experienced freight forwarders and customs brokers has the expertise to ship your goods and ensure their smooth clearance in any country.

Contact us today for a straightforward and fast import customs clearance experience.

Tips for Smooth China Customs Clearance

Here are some practical tips to consider for a smooth customs clearance:

- Start the customs clearance process early.

- Ensure your documents are accurate and complete.

- Use a standard freight forwarder or customs broker.

- Pay any applicable duties and taxes promptly.

- Be patient. The customs clearance process can take some time.

FAQs

1. What documents are required for import customs clearance in the USA?

The documents you’ll need for import customs clearance in the USA include a commercial invoice, Bill of Entry, Bill of Lading/Air Waybill, Import license (for certain goods), Certificate of Origin, ISF, Packing list, and the Arrival notice. The exact requirements may vary depending on the nature of your goods.

2. What documents are required for import customs clearance in the European Union?

In the European Union, the required documents generally include a commercial invoice, Bill of Entry, Bill of Lading/Air Waybill, Import license (for certain goods), Certificate of Origin, and Packing list. However, some requirements can vary by EU country and the type of goods you’re importing.

3. Who is responsible for customs clearance?

The importer is responsible for customs clearance. However, the importer can hire a customs broker or freight forwarder to handle the process and pay the required duties on their behalf.

4. What are the common challenges in Import Customs Clearance documentation?

Common challenges experienced during customs clearance are:

- Inaccurate or missing documentation.

- Adhering to changing regulations.

- Incorrect HS codes.

- Difficulty obtaining import licenses or other permits.

- language or communication barriers with customs authorities.

These challenges can be addressed by hiring a professional to help with customs clearance.

5. What is the role of a customs broker/freight forwarder in import customs clearance?

Customs brokers and freight forwarders are experts who simplify the customs clearance process. They can help to:

- Prepare and submit the required documentation.

- Pay duties and taxes on your behalf.

- Resolve any problems that arises during the customs clearance process.

This helps you save time and money and ensure your goods are cleared successfully.

6. How long does customs clearance take?

The time it takes to clear customs can vary depending on the type and size of the shipment, the volume of traffic at the port of entry, and how busy customs is. Usually, most shipments are cleared within a few days to a few weeks.

Make sure you have the necessary documentation and pay all fees on time to avoid delaying the clearance.

Conclusion

This article provides a comprehensive list of essential documents to facilitate your clearance process. However, it would help if you understood that using the right freight forwarder can make all the difference between a stress-free clearance and a challenging one.

At Winsky Freight, our seasoned team of customs brokers is ready to assist you in clearing your goods seamlessly, no matter the destination country. Your journey to a smooth customs clearance experience starts with us. Contact us today.

Leave A Comment