How much is the Import Taxes and Duties from China?

The amount of tax (e.g. import duty, VAT and excise) you must pay depends on the type of goods. The taxes you usually have to pay are:

- VAT (21% or 9% or nothing on the value of the goods)

- other import taxes (e.g. import duty, agricultural levies and anti-dumping taxes). It varies according to the type of goods.

- excise duty (only for goods which are subject to excise duty, e.g. whisky and wine)

What is Import Duty?

Import duty is a tax imposed by a government on goods from other countries. This increased price on imported goods is meant to make these products less “desirable” so buyers are encouraged to support the domestic market.

Do you import products from China or are you thinking of doing it? This involves several taxes that you must take into account before placing any order, as the expense increases and your idea may not be profitable. In particular, the rates of custom duties of the European Union, the VAT of the import and the fees and other expenses of the custom agents + the corresponding VAT come into play. We are going to put everything in order so you can see it easier.

VAT on imports from China

Import VAT is the tax that must be paid by the importer in extra-community acquisitions. For the most part, the tax is 21%, Austria is 20%;

21% in Belgium; 25% in Denmark; 22% in Finland;

France is 20.6%; Germany is 16%; Greece is 18%;

The Republic of Ireland is 21%; Italy is 19%;

The Netherlands is 17.5%; Portugal is 17%; Spain is 16%;

Sweden is 25%; Britain is 17.5%.

On the one hand, VAT is charged on the value of merchandise in customs (to which customs duties are previously added) and, on the other hand, it is charged on the fees and other expenses of custom agents.

Import tariffs from China

First of all you must know that the European Union is a single market, so that all its member states have the same rates of custom duties when importing from outside the EU. If imported from another EU country, they are considered intra-community acquisition.

What does make custom tariffs vary are the types of products. The European Union tries to protect its industries, so that it applies a higher rate to the type of article that is considered already produced in enough quantity in the EU. For example, shoes have a rate of 12%, electric bicycles 6% and solar panels 0%. There are also additional tariffs for certain products, such as tobacco and alcohol.

Customs costs when importing from China

At the customs value, the following costs must be included to be paid separately, if necessary:

- Commission and fees to sales agents

- Transportation costs generated in the importer’s country

- Costs generated in the port of destination

Customs authorities do not make estimates, so the declared value will be detailed in the Bill of Landing, a document issued by your supplier or carrier.

From what amount are taxes paid?

VAT is paid if the import is higher than 22 Euros for shipments sent by a company and 45 Euros for shipments between individuals.

A tariff is charged from transactions with a value greater than 150€. If the value of the import is lower, it is exempt.

How does the UK charge import duty on goods from China?

As your parcel will be from outside the EU, you may be charged VAT or excise duty on it. You’ll also need to pay customs duty on goods from China if they’re worth more than a certain value.

You’ll need to know the tariff or HS code to calculate the exact rate due. If you also need to pay VAT, it’ll be charged on the total value of your goods, including import duty.

How does the US charge Import Duties & Taxes on goods from China?

It may seem complicated but it’s actually not. Once you know your customs tariff number (official database here: https://hts.usitc.gov/) you can calculate it yourself. So before importing a product to the US you may want to find your customs tariff number first. It’s not easy to navigate on the official site but there’s another site called Simplyduty that lets you look up your customs tariff number as well and you can calculate your rough costs there as well (https://simplyduty.com)

How to check the US tariff?

- The US tariffs are very detailed. Open the US import tariff website: https://hts.usitc.gov/. Enter the product name After entering the website, then click “Search” or enter the first 4 digits of the HS code or 6 digits.

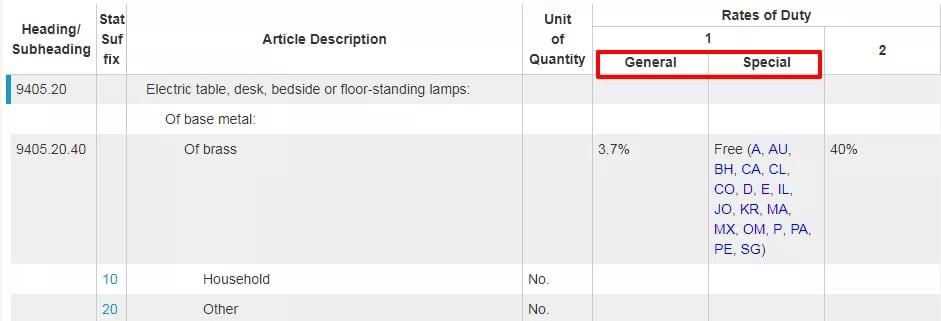

- Enter your product name to view the import tariff (Rates of Duty)

What are the meanings of 1 and 2 of the US import tariffs?

- The “General” in Tariff 1 is the tariff from most of the world’s imported products (Chinese products apply this tariff rate)

- The “Special” in Tariff 1 refers to tariffs with the United States from imports from countries with relevant FTA countries.

- Tariff 2 applies to tariffs on imports from special countries that have no trade relationship with the United States (Cuba and North Korea)

How should I declare the goods value?

You don’t have to worry, your logistics company will declare that for your. This could be a freight forwarder or a courier like DHL, FedEx, UPS.

In any event, the forwarder knows the amount of total product value and will know how to declare for you.

If you still can’t find the import tax and duty from China to your country, pls feel free to contact our team!

Leave A Comment