Customs Duty On Imports From China

If you are importing from China, you must have heard about customs duty. As China is the most popular country for importing goods, you must want to know about customs duties on imports from China.

Well depends on many factors, such as what you are importing, the weight and volume, and most importantly, the country from which you are importing products. Most countries charge somewhere between 5% and 20%, but some can go higher.

We deal with this stuff every day, so we know how confusing it gets. Therefore, we created this guide to help to learn everything about customs duties on imports from China in 2025.

- Customs duty on imports from China changed in 2026

- Customs duty on imports from China is not just about the product price

- Importing from China includes several hidden charges beyond the main duty

- A mistake in customs paperwork can cost you time and money

- How to reduce your customs duty when importing from China

- Winsky Freight makes customs duty on imports from China simple for importers

1. Customs Duty on Imports from China Changed in 2026

Customs documents and rules aren’t what they were. In 2025, many countries, particularly the U.S., went about changing how China’s goods are taxed at the border in a significant way.

If you are a person from whom products are being imported as a routine and happening in small quantities only, you might have noted it. The biggest difference? More small shipments are no longer flying below the radar.

So, whether you’re testing a product or just making a small trial order, you need to factor in your duty in advance. Low-cost items should not be assumed to slide through undetected. Those days are over.

New Rules Are Now in Effect for Most Importers

Let’s begin with China to the United States, as it made the most notable change. The U.S. lifted the $800 de minimis exemption for shipments from China and Hong Kong as of May 2, 2025.

This rule allowed minimal-value parcels to be imported without payment of duty and taxes. Not anymore.

You now have to complete full customs clearance even if you are only sending a couple of boxes via FedEx or UPS. This includes paying regular duty based on the product’s HS code, along with additional Chinese-origin goods tariffs that may apply. Total duties, depending on the category, can exceed 100% to more than the value of the product.

Reuters explains the rate changes here, and no, these rules aren’t temporary. They’re already being enforced.

Small Shipments Are No Longer Always Duty-Free

A lot of the small importers would be affected by this point. For years, a lot of people had businesses centered on low-value shipments from China. Whether it was garments, accessories, or electronics, anything above $800 and you tended to always cough up a few duties.

That loophole closed in 2025. At least for packages from China and Hong Kong.

By contrast, postal parcels under $800 now receive a flat per-item duty. The cost of the fee, initially set at $25, doubled to $50 per item, regardless of what you’re importing, on June 1. (AP News covered the change)

Courier shipments are handled differently. They are taxed depending on the HS code of the product. For a lot of things — whether it’s clothing, tech devices, or home tools, those are high rates. In some cases, the overall duty rates are up to 125% or higher once layered tariffs are activated.

Big platforms like Temu and Shein, which enjoyed the duty-free model a lot, have already started transforming their logistics here. Some are moving their inventory into warehouses within the U.S. to avoid the issue. Business Insider explains how they’re adjusting

So, even if you’re just testing a product or placing a small trial order, you need to calculate duty ahead of time. It’s not safe to assume low-value items will pass through unnoticed. Those days are over.

2. Customs Duty on Imports from China Is Not Just About the Product Price

Many people, when they first begin importing, think that customs duty is payable only on the value of the product. But that’s not how it works.

The last quantity that you pay is calculated based on something called the CIF value, where “CIF” is short for “Cost, Insurance, and Freight.” That means your shipping cost and insurance are factored in as well.

Freight and Insurance Are Included in the Final Calculation

Let’s just say you order products from a Chinese supplier for $2,000. If the shipping is $500 and insurance $100, the customs value is not $2,000, but $2,600. That is what the customs officer inputs to determine the duty.

So even if your goods are cheap, high freight rates can push up the total. Air shipments, express delivery, or sending to remote areas? All of those can raise the CIF value, and your customs bill along with it.

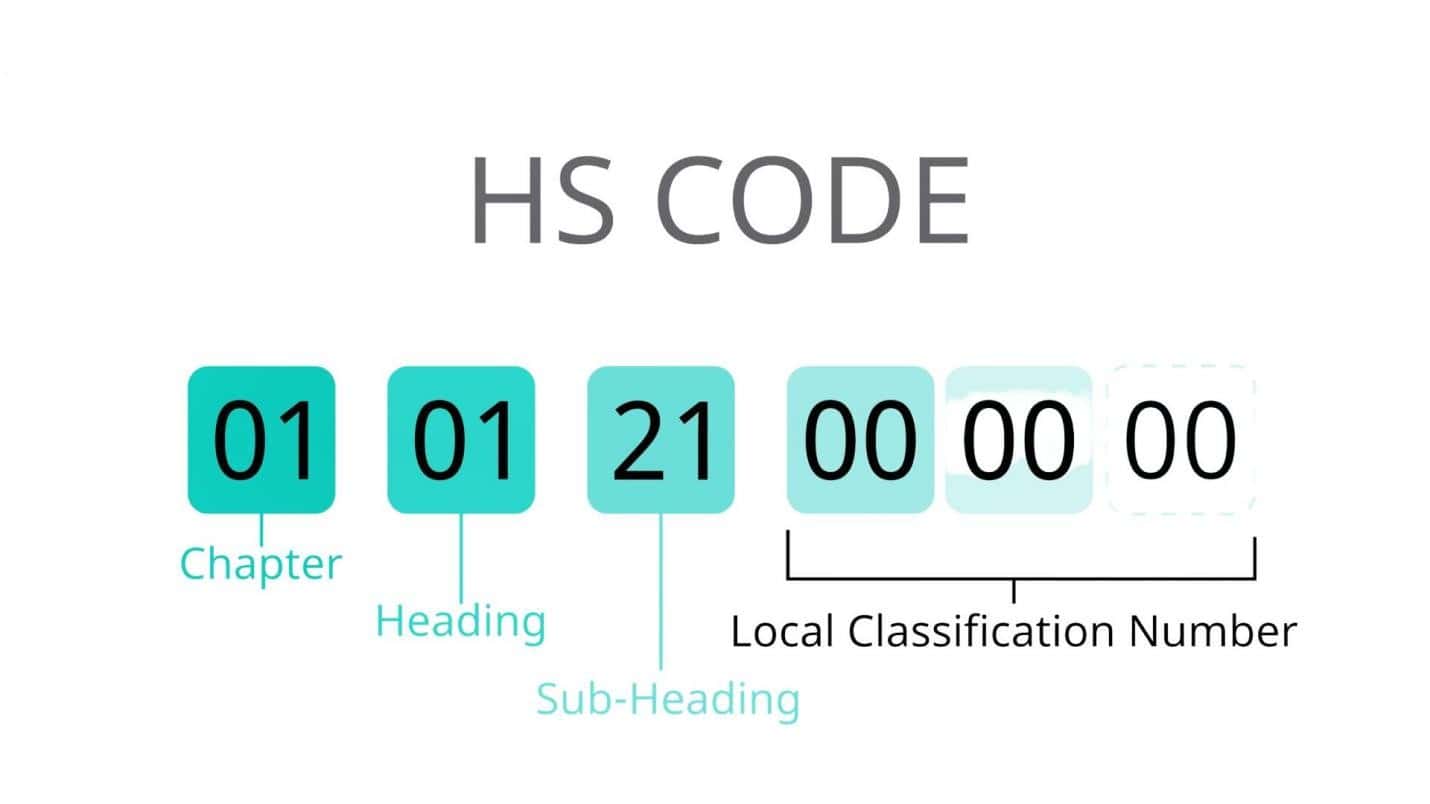

Your Product’s HS Code Sets the Duty Rate

Everything has an HS code, a number that countries around the world use to classify goods. It’s not just for paperwork. A duty amount is assigned based on that number.

For instance, a cotton T-shirt and one in polyester could have different codes and duty rates. Incorrect labeling of the HS code may amount to overpayment, or even worse, shipment delays and fines. So it’s always best that you verify the code with your supplier or freight forwarder.

Some importers use the incorrect code to avoid having to pay as much duty. It’s possible to get away with it once, but customs departments are becoming more stringent. If your product is flagged, you will end up losing more than you save.

Some Goods Now Face Extra Tariffs Due to Trade Policies

It’s no longer just ordinary customs duty. In the past few years, a few countries have imposed supplemental tariffs on some Chinese products. These have nothing to do with what your product is or how much it’s worth, but with political or trade issues.

Electronics, machinery, steel products, and even furniture are now on special watch lists in some countries. This means you are being charged a higher duty rate, often two or three times the standard rate.

These surcharges fluctuate frequently they vary in every country. That’s why you need either to keep up with the news or be sure to check with someone who follows trade rules on an ongoing basis.

Here is a sample example of how customs duty is calculated

| Item | Amount (USD) |

|---|---|

| Product Price | $2,000 |

| Freight (Shipping Cost) | $500 |

| Insurance | $100 |

| Total CIF Value | $2,600 |

| HS Code Duty Rate (e.g., 10%) | $260 |

| Additional Tariffs (if any) | e.g., $100 |

| Total Duty Payable | $360 |

3. Importing from China Includes Several Hidden Charges Beyond the Main Duty

Customs duty is only part of the cost. There are many importers who are stunned to find extra charges when their shipment lands. These are not arbitrary fees; they are customary in global trade.

MPF, Port Charges, and Brokerage Fees Often Apply

If you’re importing to the U.S., there is a thing called the Merchandise Processing Fee (MPF). It is not a measure of weight or volume; rather, it is assessed as a small percentage of the value a consumer claims, subject to a minimum and a maximum.

The MPF is applicable even if you have low or no duty.

Port fees are another potential cost. These are charges for unloading, container handling, storage, and sometimes inspection. They differ from one port to another, and if your shipment remains for longer than you expect, storage charges can quickly add up.

Then there’s the customs brokerage fee. That’s what you pay a licensed broker to get your goods through customs. You can always try to do it on your own, but in general, most importers prefer to leave it to the pros.

The fee depends on your shipment size, how complex the paperwork is, and the country you’re importing into.

You May Also Be Charged VAT or Other Local Taxes

On top of that, many countries levy VAT (Value Added Tax) or GST (Goods and Services Tax) on imported items. The tax is usually levied according to the total value of the shipment, which can also include your product, shipping, insurance, and even the duty itself.

In the EU, the value for this rate can vary within the range of 17 percent to 27 percent. An incentive for refunds, up to 3% of the value of the product in some cases, is also paid to the importers in countries including India and Canada, and GST and state-level or provincial taxes are also paid by importers in India, Australia, or Canada.

So if your customs duty seems reasonable, remember to consider these extra charges as well. They can drive up your total cost by 10% to 30% or more, depending on where you’re importing.

4. A Mistake in Customs Paperwork Can Cost You Time and Money

There’s more to importing than selecting a product and finding a rush shipping rate. If your documents are incorrect, your shipment can be held up, fined, or even detained at the border. And once that happens, the rest, like delivery, sales, and customer timeline, fall apart.

Wrong HS Codes Increase Your Duty on Imports from China

Your product’s HS code determines how much duty you pay. Skirt such codes, and you might pay much more than you should, or too little, a devil that comes back to haunt you later.

You are importing cotton T-shirts, but you or your supplier is using a general “fabric” code instead. That could push your duty rate from 10 percent to 17 percent, just like that. They may not notice it right away on the customs side, and when they do, you could face fines, fees, or a difficult time shipping in the future.

Some suppliers may assign codes without checking the local rules of your country. Therefore, you should not just blindly rely on them. Always confirm the correct HS code based on your own country’s tariff schedule. If you are not familiar with this, then ask your freight forwarder from China to help you.

Incomplete Documents Delay Clearance, or Get Your Goods Held

An incomplete or illegible document is another frequent reason for shipment delay. Partial invoices, packing lists, or bills of lading won’t go through customs.

Small mistakes like wrong product details, missing signatures, or quantity mismatches can cause delays. Customs in some cases can require additional paperwork, assign a physical inspection, or store your goods at your expense.

These pitfalls are easy to stumble into for first-time or smaller importers, and they are costly. Delays could result in warehouse fees, lost sales, or, for customers who have not canceled back orders yet, disappointment.

Don’t treat customs paperwork as an afterthought. It is as important as the product.

5. How to Reduce Your Customs Duty When Importing from China

There is no cheat code, but yes, you can reduce your customs costs if you plan accordingly. Not every shipment, but in some cases it happens.

Use Bonded Warehouses or Temporary Entry Options

If you’re not looking to sell your goods immediately, a bonded warehouse might buy you time. Your package arrives in a warehouse, is tucked away in storage, and you don’t pay a cent until it comes out the other side. And for stocking up on seasonal stock or bulk buys, it’s a cash flow aid.

There’s also something called temporary import, for when goods aren’t staying for good: for example, if they’re for samples, event setups, or rented machines. You clear them in, use them, then send them back out. No full duty.

But you must work through the process. There will be no bending of the rules if the forces at the border or airports are overtaxed by dealing with literally hundreds of thousands of people trying to get into the country.

Customs won’t bend the rules if the paperwork’s off.

Split Shipments—Only If It Actually Saves You Money

Sometimes, sending two smaller shipments costs less in duty than one big one. That’s mostly in countries where small parcels get a break.

But it doesn’t always work. Courier fees might wipe out the savings. And if customs see you splitting shipments just to dodge rules, they can flag you. So, only do it if it makes sense, not as a trick.

Also, separating goods by type (if they have very different HS codes) can help. It keeps things cleaner during clearance and avoids being overcharged.

Stay Under Low-Value Thresholds—When You Can

Two smaller shipments, instead of one large one, will save you money on duty. That, with a few exceptions in countries where small parcels receive a break.

But it doesn’t always work. Courier charges could erase the savings. And if customs catches you trying to split shipments as a way of getting around the rules, they can pin a flag on you. So do it only if it makes sense.

Sorting items by type (if they have significantly different HS codes) can be a help. It helps to prevent things from getting messy in the clearance and overcharging.

Winsky Freight makes customs duty on imports from China simple for importers

Customs duty isn’t just paperwork. It can determine how much you pay, how quickly your goods move, and sometimes whether or not your shipment gets blocked. And given all the new rules like tariffs, HS codes, and value calculations, there’s a lot to figure out.

That’s what we help with.

Here at Winsky Freight, we do this stuff every single day. We’ve done work with importers of all sizes, from individuals trying out a new product to businesses bringing in full loads each month.

We sort the documents, make certain the codes are appropriate, and try to keep things moving without surprises.

Need help with your next import from China? Get in touch with us and we’ll make the customs process simple, clear, and stress-free.

Leave A Comment