What is incoterms CIF mean | Everything you need to know

If you’re familiar with international trade, then you must have come across the popular incoterm called CIF. This incoterm is renowned for its convenience, especially for buyers. But why is that the case? Allow us to shed light on it in this article.

We have compiled all the information you need to know about CIF. We’ll walk you through the roles of buyers and sellers, the point of risk transfer, and the pros and cons so you can decide whether this incoterm aligns with your needs.

What is CIF Incoterm?

CIF-Costs, Insurance, and Freight- is another popular incoterm that can only be used for ocean freight or inland waterway shipments.

In this incoterm, the seller exports the cargo and pays freight costs and insurance charges till the goods reach the agreed destination port. Although the seller pays for freight charges and insures the cargo, their responsibility ends once the goods are safely on board the shipping carrier. From this point, the risk of the shipment transfers to you. You then handle the import clearance and transport the goods from the destination port to the final destination.

The seller must provide insurance for your goods under a CIF agreement. The insurance should be at least 110% of the declared value of your goods and should cover the goods till they reach the destination port.

One important detail to note about CIF is that the point of risk transfer is different from the point of cost transfer. Remember, the seller covers freight and insurance costs, therefore the cost transfer happens when the goods are at your destination port. However, once the goods are loaded on the vessel, the risk of the shipment shifts to you. This means you’re liable for any damages or loss during transit. If your goods are damaged, you can make a claim with the seller’s insurance company.

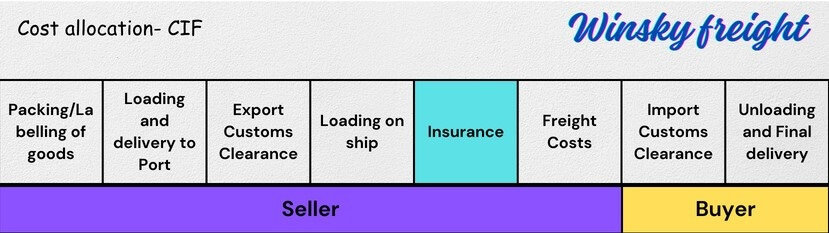

What are the responsibilities of Buyers and Sellers in CIF?

CIF lists clear obligations for both buyers and sellers.

Seller’s Responsibilities:

- Package the goods to be ready for shipping.

- Deliver the goods to the agreed destination port.

- Arrange and pay for insurance to cover the goods during shipping.

- Handle export customs clearance

- Pay freight charges.

- Load the goods onto the ship

- Hand over necessary shipping documents to the buyer

Buyer’s Responsibilities:

- Bears damages during shipping

- Receive and unload the goods from the ship at the destination port.

- Handle import clearance and pay customs duties

- Transport the goods to the final destination.

When should I consider using CIF?

Sellers mostly choose CIF because they can make more profit. But you can consider using CIF when:

- You’re inexperienced with international shipping.

- You want the seller to handle freight and insurance costs.

- You want the convenience of having goods delivered to your local port.

- You want your goods shipped by sea

- Your shipment is small

Advantages of CIF for the buyer

CIF is a convenient shipping option for the buyer because the seller handles most of the logistics burden. Here are the benefits of using this incoterm:

- Beginner friendly: CIF is one of the most friendly incoterms for newbies to international trade. It is straightforward to navigate.

- Less stress: CIF reduces your involvement in shipping, insurance, and customs procedures because the seller manages them for you.

- Convenience: CIF makes shipping very easy for you. The goods are delivered to the destination port, which saves you time and effort.

- Hazardous goods: When shipping dangerous goods, the seller is responsible for obtaining the necessary licenses and securely packaging the items for safe transport.

- Insurance: The seller is obligated to purchase insurance for your goods till they reach the destination port, which helps to settle losses in case of shipping mishaps.

- Predictable Budget: With CIF, you have a clear understanding of costs upfront, including shipping and insurance, which makes budgeting easier. You won’t be caught off guard by sudden changes in freight costs because you’re not responsible for the shipping charges.

- Global Access: CIF allows buyers to access goods from different parts of the world without being directly involved in intricate shipping details.

Disadvantages of CIF for the buyer

CIF is oftentimes not a great option for buyers because it means you lose control of the shipping process while bearing a large part of the risk.

- Less Control: You have limited control over the shipping and insurance choices made by the seller. For instance, you might not be able to choose the freight forwarder, and the selection made by your seller might not be reliable. If issues arise, resolving them directly can be a challenge.

- Higher Costs: It is much more expensive for you compared to other Incoterms like FOB. The seller includes the cost of shipping and insurance, which will make the costs much higher than if you arranged for them yourself.

- Potential for scams: CIF leaves you at the mercy of greedy sellers who may inflate shipping costs to boost their profits at your expense.

- Customs complexities: You are still responsible for import customs clearance, which can be difficult if you’re not familiar with local regulations.

- Shipping risks: Losses or damages to goods during transit are your responsibility, not the seller’s. Filing a claim with the seller’s insurance company to resolve this can be tricky, given the insurance is in the seller’s name. Discovering damaged goods in time to file a claim before the transaction ends can also be challenging.

- Cheap and inefficient shipping choices: Sellers often select cheap freight forwarders and shipping carriers to save costs. This can lead to shipping delays for which you bear the consequences.

- Import requirements: Sellers may not know some import requirements for specific countries. As a result, they may not provide you with some necessary documents like the ISF, which may lead to fines.

- Not suitable for container shipping: CIF is not advisable for goods shipped in containers. This is because these goods may spend days in the terminal before shipping. Since containers are usually sealed until the destination port, any damage to the goods might not be discovered before they’re loaded on the ship. You should use CIP or FCA incoterm when shipping with containers.

- Difficulty in tracking shipment: Since you have little control over the freight process, it’s difficult to monitor your goods during transit to know the shipment’s status.

As you can see, CIF primarily benefits newcomers to shipping who lack experience in international trade. For more experienced buyers, the disadvantages are numerous.

How Do I Calculate the CIF Price?

The amount of customs duty you pay during clearance is determined by the CIF value of your goods. It is therefore important to get this calculation accurately.

The CIF value is a total of:

- The total production costs of the goods as stated in the commercial invoice.

- The value of the insurance paid (Usually at least 110% of good value)

- The freight costs

- Transportation costs from the seller’s warehouse to the port.

You can calculate using this formula:

Cost of goods + Cost of Insurance + Freight Costs + Transport to port costs

Best Alternatives to CIF

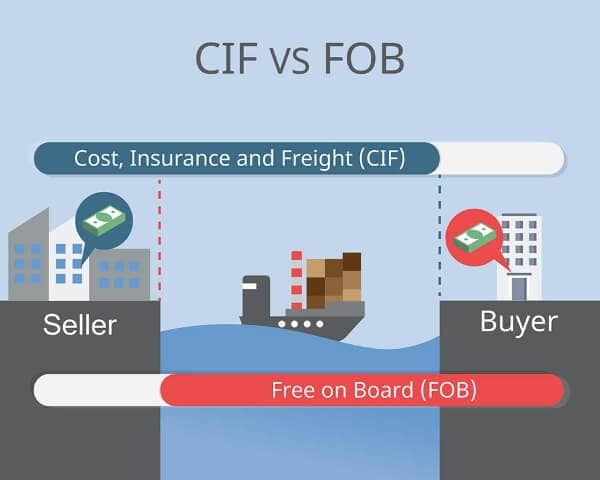

CIF Shipping vs. FOB Shipping

In FOB shipping, the risk transfer also occurs immediately after the goods are on the ship, but the seller isn’t responsible for freight costs, unlike CIF.

The key distinctions between CIF and FOB are that the seller covers freight costs and must provide insurance in CIF.

While those who are unfamiliar with the process prefer CIF, seasoned buyers prefer FOB because it allows them more control over shipping. However, remember that CIF is more expensive than FOB.

CIF Shipping vs. CFR Shipping

CFR is closely related to CIF. In CFR, the seller is also responsible for paying freight costs, managing customs clearance, and shipping goods to the destination port. The key distinction between them is insurance.

While the seller must pay for insurance for goods during CIF, the seller is not obligated to do this in CFR shipping. However, the seller can include insurance if they choose to.

CIF Shipping vs. DDP Shipping

DDP is the most buyer-friendly incoterm because it places all the shipping responsibilities on the seller. In DDP shipping, the risk remains with the seller until the goods are delivered to the buyer’s location, unlike in CIF, where the risk switches to the buyer once the goods are on board the ship.

FAQs

When does risk transfer occur in a CIF agreement?

Risk transfer is different from cost transfer with this incoterm. Costs are transferred upon arrival at the destination port, but the risk is transferred while the goods are on board the ship.

Who Pays CIF Freight costs?

The seller is responsible for paying freight costs in CIF shipping.

What is the difference between CIF and CFR?

The key distinction between them is insurance. While the seller must pay for insurance for goods during CIF, the seller is not obligated to do this in CFR shipping.

Can I use CIF for Air Freight?

No, you cannot. CIF works for ocean freight and inland waterway shipments. Consider using CIP incoterm instead.

Conclusion

As we’ve mentioned in this article, CIF is often favored by those new to international shipping. Despite the convenience, it can be more costly and inefficient, which discourages experienced buyers. Throughout this article, we have covered the various roles expected of you and the seller in a CIF agreement. You should weigh the pros and cons before you decide on this incoterm with your seller.

If you’re considering CIF for your goods, then partner with Winsky Freight. We can help you monitor your shipment and handle import clearance, thereby simplifying the shipping process for you. Contact us today.

Leave A Comment