What is Incoterm DDU? Everything you need to know

Incoterms are important rules that define the roles of buyers and sellers in international trade. Having a clear understanding of these trade terms is essential for you to have a smooth shipping experience and prevent misunderstandings with your seller. Today, our focus will be on the DDU incoterm.

Our detailed guide contains all relevant information about the DDU incoterm. We’ll delve into the responsibilities of buyers and sellers, the point of risk transfer, and analyze the pros and cons. With this knowledge, you’ll be able to decide when and how to use the DDU incoterm.

What is Delivered Duty Unpaid (DDU)?

Delivered Duty Unpaid (DDU) is an old incoterm that stipulates that the seller’s responsibility ends when the goods are delivered to the buyer’s named destination without paying import duties and taxes in the buyer’s country. Once the goods arrive at the agreed delivery point, it’s the buyer’s responsibility to handle import clearance, pay customs duties, and transport the goods to the final destination.

A simple way to remember DDU shipping is this: The seller manages shipping responsibilities in their country, while you handle them in yours. This is efficient because sellers might not be as familiar with your country’s import regulations as you are.

Although the DDU agreement stipulates that the seller’s job ends at the destination without paying for customs duties, you can make negotiations to modify the agreement with your seller. For example, you can ask the seller to assist with import formalities or insurance. Just make sure everything you agree upon is clearly stated in the contract

DDU can be used with any shipping mode. You should know that the DDU incoterm has been officially replaced by DAP (Delivered at Place) since 2010, but many importers still choose this incoterm. When dealing with DDU shipping, using your own freight forwarder is the best way to simplify the entire shipping process.

What are the responsibilities of Buyers and Sellers in DDU?

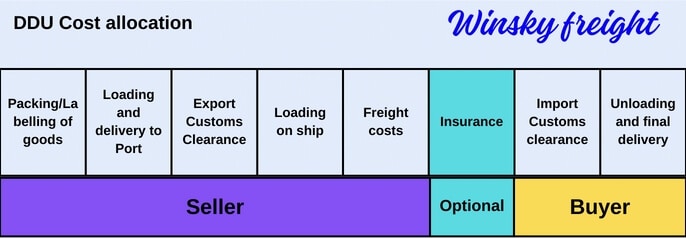

In DDU shipping, the responsibilities are almost evenly divided between buyers and sellers. Here’s a breakdown of their roles:

Seller’s Responsibilities:

- Package goods for shipping.

- Transports goods to the port of origin.

- Loads goods onto the ship

- Obtains necessary export licenses and handles export Clearance

- Pays freight charges and other shipping costs.

- Delivers the goods to the buyer’s named destination.

- Bears any losses that occur during transportation.

- Provides necessary shipping documentation to the buyer

Buyer’s Responsibilities:

- Pays for the goods according to the seller’s invoice

- Unloads the goods at the destination port

- Obtains necessary import licenses and handles import customs clearance

- Pays Customs Duties and taxes

- Transports goods to the final destination

- Bears all risks for goods after receiving them at the named destination.

Both parties must communicate clearly and agree on these responsibilities in the sales contract to avoid misunderstandings.

When does risk transfer to the buyer in the DDU agreement?

The transfer of risk occurs when the goods are delivered at the agreed destination. Specifically, the seller bears the risk before the delivery of goods, and the buyer bears the risk afterward.

Pros and Cons of DDU for the Buyer

Pros of DDU for the Buyer

- Convenience: You don’t need to worry about the logistics and transportation of the goods in the seller’s country, as you only get involved in your own country.

- Lower initial cost: DDU is beneficial for buyers on a tight budget as they invest less money upfront for the goods.

- More control over the import process: If you’re familiar with the import process in your country, DDU allows you to choose your customs broker and negotiate the import duty and tax rates. This can help you save money on import fees.

- Potential for tax benefits: Leveraging personal networks at customs can make the import formalities easier. You may qualify for tax discounts that reduce your overall costs.

- Flexibility with destination: You’re free to choose the destination you want your goods delivered and unloaded.

- Easy Tracking of goods: You can easily monitor the status of your goods once they’re in your country.

Cons of DDU for the Buyer

- Uncertainty about import costs: Import costs are unpredictable, and may end up being way more than you expect. There’s always the possibility of surprise tax charges and unexpected brokerage fees.

- Complex Customs Procedures: Managing import customs clearance and complying with local import regulations can be challenging, especially if you’re unfamiliar with the procedures. This can lead to delays in receiving the shipment.

- Risk of damage or loss: Once the goods are in your possession, you’re responsible for any damage or loss.

Pros and Cons of DDU for the Seller

Pros of DDU for the seller

- Convenience: DDU provides the seller with less administrative burden concerning import regulations and customs procedures because their involvement is limited to their own country.

- Reduced financial risk: By avoiding responsibility for import duties and taxes, the seller can reduce the financial risk associated with fluctuating fees.

- Reduced Liability: The seller is not liable for issues that may arise during the buyer’s handling.

- Competitive advantage: DDU can help the seller offer more competitive prices to buyers, as “import duties” and taxes are not factored into the selling price.

- Faster delivery: The seller can complete the whole shipping process much faster since they’re not responsible for import customs.

Cons of DDU for the Seller

- Unpredictable cash flow: DDU can lead to unpredictable cash flow for the seller, as payment may not be received until the buyer has cleared customs and paid import duties.

- Potential disputes: Sometimes the buyer faces additional costs during import clearance that may cause dissatisfaction and disputes with the seller.

- Reduced profit margin: The exclusion of import duties and taxes from the selling price means the seller charges for a lesser number of shipping steps, leading to a reduced profit margin.

Best Alternatives to DDU

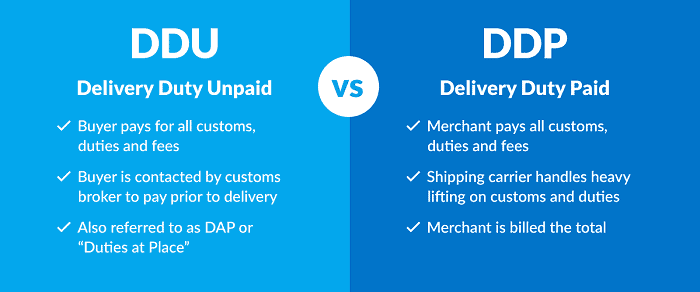

DDU Shipping vs. DDP Shipping

Delivered Duty Paid (DDP) shipping places the majority of the shipping process on the seller, who not only bears all the risks but also covers shipping costs, import and export clearance, and final delivery to the buyer’s destination. In contrast, DDU shares the responsibilities more evenly between the buyer and seller. Here, the seller manages export clearance, while you handles import clearance and duties when the goods arrive at the destination port.

As a result, you can expect your DDU shipping to be cheaper than DDP because you’re only charged for the price of goods and shipping fees in DDU, whereas you’ll be charged additional costs for import duties and inland transportation delivery in DDP.

Generally, DDP is considered simpler for a buyer. If you want a convenient shipping process without the possibility of unforeseen charges, then DDP is preferable. However, if you’re more concerned with controlling the shipping process, then DDU is the better option.

DDU Shipping vs. EXW Shipping

EXW (Ex Works) is the incoterm where the seller has the fewest shipping responsibilities. Their only responsibility is to get the products ready for pickup in their warehouse, and the buyer does the rest from there. DDU, on the other hand, only requires the buyer to get involved with the goods after they arrive in the destination country.

EXW is the cheapest incoterm because the seller doesn’t have much to do. If you’re an experienced buyer, choosing EXW instead of DDU can help save costs. But keep in mind that it can be very stressful because the responsibility of shipping to your country and managing export and import customs clearance falls entirely on you.

EXW (Ex Works) is the incoterm where the seller has the fewest shipping responsibilities. Their only responsibility is to get the products ready for pickup in their warehouse, and the buyer does the rest from there. DDU, on the other hand, only requires the buyer to get involved with the goods after they arrive in the destination country.

EXW is the cheapest incoterm because the seller doesn’t have much to do. If you’re an experienced buyer, choosing EXW instead of DDU can help save costs. But keep in mind that it can be very stressful because the responsibility of shipping to your country and managing export and import customs clearance falls entirely on you.

DDU Shipping vs. CIF Shipping

In the CIF incoterm, the “seller” takes on the responsibility for the Cost, Insurance, and Freight of the goods until they reach the destination port. The buyer then receives the goods at the destination port and handles the import clearance process. Although there are some similarities between CIF and DDU, one significant distinction is that CIF mandates the seller to provide insurance, while DDU does not.

FAQs

Who is responsible for shipping in the DDU agreement?

The seller is responsible for shipping goods and paying freight costs under the DDU incoterm.

Is insurance included in DDU shipping?

No, it’s not. Although DDU mandates the seller to manage all shipping risks to get your goods to the destination, it does not oblige them to pay for insurance. Neither is there an obligation for the buyer to do so.

In any case, many sellers who use DDU voluntarily choose to purchase insurance for added security. If you wish to obtain the insurance on your own, you can also discuss it with your freight forwarder or seller. You should consider CIF or CIP agreements if you are worried about shipping under incoterms without insurance.

Who handles customs clearance in DDU shipping?

DDU splits the responsibility for customs clearance between the seller and buyer. The seller is responsible for export customs clearance in their country, while the “buyer” is responsible for import customs clearance in theirs.

What is the difference between DDU and DAP shipping?

The Delivery at Place (DAP) and DDU Incoterms are essentially the same. The International Chamber of Commerce (ICC) introduced DAP to officially replace DDU starting from the Incoterms 2010 edition. Importers can choose either option for their international trade.

Conclusion

In this article, we have explained the various roles expected of you and the seller in a DDU agreement. It is advisable that you only choose DDU when you have prior experience with customs clearance in your country. If handling it on your own is challenging, there’s no need to worry- just partner with Winsky Freight.

Our experienced international team of freight forwarders and customs brokers is ready to assist in shipping and clearing your goods from China to any destination country. Our services are cost-effective and completely hassle-free. Contact Winsky today for a smooth shipping experience.

Leave A Comment