Air Freight from China to Canada: The Ultimate 2026 Guide for Importers

Breaking: During December 2025, the air freight rates registered a change of nearly 17%. The Canada Border Services Agency (CBSA) attributed the reason to the holiday rush of Q4.

That’s what shipping from China to Canada is all about! The last changeover steps of CARM are expected to finish by the end of the year.

The skies between these areas are becoming more and more challenging to navigate for business owners, Amazon sellers, and procurement managers.

Maybe you’re in a rush to restock inventory for the demand of the holiday season. Or perhaps, you’re managing a lean supply chain.

In either scenario, understanding these current nuances of air cargo is vital for profitability.

To get a better understanding of operational realities, let’s get into it.

Key Takeaways:

Air freight is 5-8x faster than sea freight. However, the understanding of “Chargeable Weight” decides how much you can benefit. You must register for the CARM portal by the end of this month before the “Safety Net” expires.

Table of Contents

| Section | Key Finding |

|---|---|

| 1. Air vs. Sea Freight | Air is viable for high-value goods or shipments under 300kg; otherwise, sea freight wins on margin. |

| 2. 2026 Cost Breakdown | Rates have hit ~$6.80/kg to Toronto; consolidation is key to reducing this. |

| 3. CARM & Customs | The “Broker’s Bond” transition exception ends Dec 31, 2025. You must register now. |

| 4. The Shipping Process | Correct Incoterms (FOB vs. EXW) determine who controls the freight costs and risks. |

| 5. Amazon FBA Tips | Amazon Canada requires strict palletization standards that differ slightly from US fulfillment centers. |

| 6. Common Mistakes | Ignoring volumetric weight is the #1 reason for unexpected shipping bill shocks. |

Is Air Freight Right for Your Business? (Speed vs. Cost)

Air Freight Is Right for Your Business If Chosen Wisely

When it comes to air freight vs sea freight, it’s not just about speed but also about capital turnover.

Your products can’t be sold or liquidated if they are stuck for 35 days on a boat.

Express vs. Standard Air Cargo

There are two distinct “lanes” in the sky, and choosing the wrong one can double your costs.

- Express (Courier): Packages managed by large organizations like DHL, UPS, FedEx, etc., are mostly delivered in this way. With this type of service, Customs is also expedited. It’s suitable for small samples or light shipments of up to 100

- Standard Air Freight: Transported by Commercial Airlines (like Air China, Cathay Pacific, Air Canada, etc.) or Dedicated Freight Aircraft. We refer to it as an Airport-to-Airport service because you (or your freight forwarder) have to provide transportation from the airport for your shipment. For a shipment between 100 kg and 1000 kg, this can be economical.

Pro Tip: For low-priority shipments heavier than 500kg, Sea Freight is mostly the wiser and economical choice. Using air freight can help you avoid a stockout, and it also prevents lost sales; therefore, it soon pays for itself.

Air Freight Costs from China to Canada

It’s good to know your cost structure to negotiate better. Air freight pricing is variable because there’s no set postage.

The pricing is currently high from China to Canada due to peak season demand and global fuel surcharge in January 2026.

Current Market Rates

If your shipment is over 1000kg, you can expect:

- To Vancouver (YVR): $5.50 USD/kg (Stable)

- To Toronto (YYZ) / Montreal (YUL): $6.80 USD/kg (Up ~17% due to congestion)

Components of Your Quote

Remember, your requested quote includes:

- Air Freight Rate: Airline cost per kg charged by the airline.

- Fuel Surcharge (FSC): Related to oil prices.

- Security Surcharge (SSC): Screening fees in airports.

- Terminal Handling Charges (THC): For handling cargoes (e.g., paid to airports like Shanghai Pudong or Vancouver Int’l).

Common Weight Breaks

Airlines offer discounted pricing depending on the quantity. For instance:

- +45kg: Base rate.

- +100kg: 10-15% discounted rate per kg.

- +300kg: Best “Economy” air rates kick in.

In general, it’s cheaper to pay for 100kg at the lower rate than for 90kg at the higher rate (e.g., 90kg versus 100kg).

Have a laugh with this classic gimmick called “paying for the break point!”

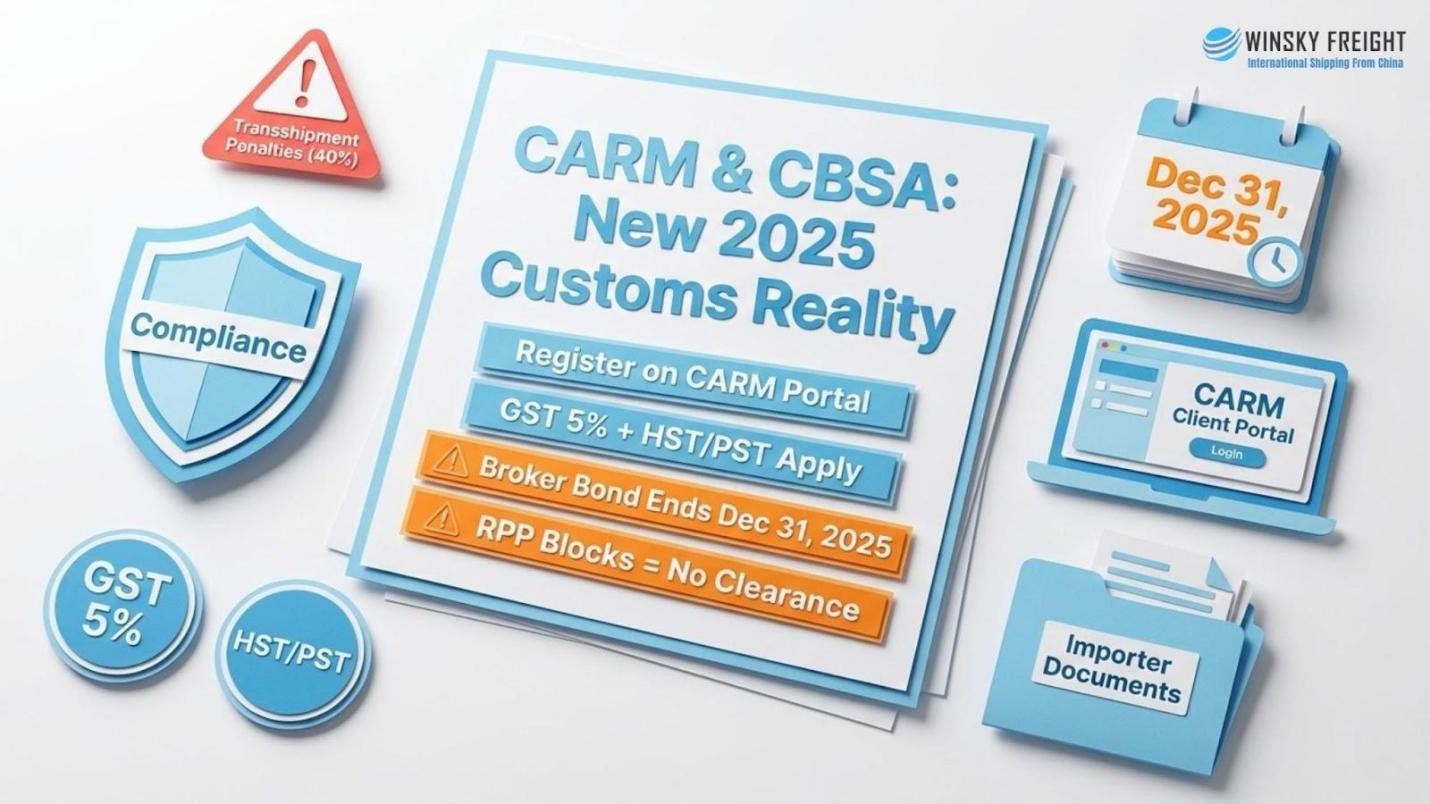

New Canadian Customs Reality: CARM and CBSA Compliance

In the past years, the bond of your customs broker could clear goods. In 2025, however, because of the CBSA (Canada Border Services Agency) Assessment and Revenue Management (CARM) project, this was no longer the case.

CARM Client Portal (CCP) & The December 31 Deadline

The Canada Border Services Agency now requires importers (that’s you) to register directly in the CARM Client Portal.

- “Safety Net” Ends: The safety net, which was meant to be in effect until May 20, 2025, allowed brokers to use their own bond for some importers as a transition measure. This exception expires on December 31, 2025.

- Strict Liability: After this date, if you haven’t posted your own financial security in the portal, you will most likely get Release Prior to Payment (RPP) blocks, meaning your goods will get held at the airport until the duties are paid in full.

Duties and Taxes

The USA has a generous de minimis of 800. In comparison, Canada has an extremely low threshold (CAD 20 in taxes, CAD 150 in duties under the USMCA/CUSMA, though standard rates are used when dealing with China).

- GST: A 5% GST will be added to the total cost of items plus duties.

- Provincial tax (PST) or Harmonized Sales Tax (HST): Some provinces (e.g., Ontario is 13% HST) charge more.

- Transshipment Warning: Since August 2025, Canada has imposed strict penalties (up to 40%) for goods transshipped to evade tariffs. We recommend keeping your supply chain transparent.

For a no-headache experience, ensure you got the correct Customs Clearance Documents and a valid business number.

Step-by-Step Process: Shipping from China to Canada

Yes, it’s true that dealing with cargoes feels like a relay race unless you’re partnered with an experienced freight handler.

Here’s how you’ve to handle the baton at every stage.

- Incoterms Decision: Are you buying EXW (Ex Works) or FOB (Free on Board)?

- EXW: You pay for everything from the factory door.

- FOB: Your supplier pays to get the shipment to the airport. For beginners, we advise sticking to FOB to reduce risk in China.

- Pickup & Consolidation: If you’re working with multiple suppliers, use Freight Consolidation. This way, you can combine goods from Yiwu, Shenzhen, Guangzhou into a single shipment, meeting that +100kg price break (we do this a lot for our clients).

- Export Clearance: Ensure your products get clearance from the Chinese customs. Some specialized goods, like batteries, liquids, require MSDS reports here.

- The Flight: It takes around 10-12 hours for direct flights to Vancouver (YVR). Flights to Toronto (YYZ) or Montreal (YUL) usually take longer, although preferred by many, as these are closer to major consumer markets.

- Import & Delivery: Upon arrival, your products will be transported to the bonded warehouse. And once customs (CARM) gives the clearance, they are trucked to your door.

Shipping from China to Amazon FBA Canada

There’s an extra logistical link for Amazon sellers. You’ve to take a delivery appointment from Canada’s fulfillment centers (like YYZ4 in Brampton or YVR4 in Delta).

- Palletization: That’s to say, in contrast to the loose cartons that you would ship to a home, Amazon would prefer to receive pallets that comply with the ISPM-15 standards (heat-treated woods).

- DDP is King: Amazon won’t pay duties on your behalf. You must use DDP Shipping from China (Delivered Duty Paid). Here, your freight forwarder must pay all duties and taxes in advance.

- Labeling: You’ve to add FBA shipment labels on every carton, and the “Made in China” mark is legally required on all units.

Also, check out our guide on the Amazon FBA Forwarder Guide to avoid rejection at the dock.

Top 3 Mistakes to Avoid When Importing From China To Canada

We know that already feels like a lot to digest, even experienced importers slip up. Still be careful of these pitfalls that would drain your budget.

1. Ignoring Chargeable Weight

Air freight is charged on Gross Weight or Volumetric Weight, whichever is higher.

- The Rule: 1 CBM = 167 kg.

- Example: If you ship a large box of pillows weighing 50kg, but the volume is 1 CBM, you will be billed for 167kg, not 50kg.

Solution: Compress soft goods and optimize packaging. Learn more about

2. Ambiguous HS Codes

Never use the wrong HS Code; it can lead to overpaying duties or, worse, border seizures.

Winsky Freight’s team can help classify your goods accurately under the Canadian tariff schedule.

3. Last-Minute Booking

During the peak seasons (like pre-Chinese New Year or Black Friday), space booking prices will get much higher.

It’s wiser to always plan your Peak Shipping Season strategy 3-4 weeks in advance.

Conclusion

The winning strategy to ship air freight from China to Canada is about balancing the urgency of speed with the strict compliance demands.

With the implementation of CARM and the fuel price hike, it’s not a beginner’s game anymore. You’ve to pair up with a partner who understands both the logistics of the sky and the laws of the border.

We’ve already tackled this for 24,700+ clients this year, and we can help you, too. Just reach out to the Winsky Freight team to grow your business!

Leave A Comment