How To Get Import License In Canada?

If you want to import goods from the outside world to Canada, you should have an Import license in Canada.

Importing goods to Canada from many countries such as China, Mexico, and the USA (Be cautious, Donald Trump is imposing additional tariffs) can help you develop a profitable business.

But how to get import license in Canada?

If you are a newcomer in this industry, this should come first on your mind. Without spending much time, let’s know in detail.

What is an Import License in Canada?

Canada’s import license is a document issued by the government permitting individuals to bring in particular goods into the country.

It is important to make sure all goods imported into Canada are in accordance with Canadian trade agreements, safety standards, and laws.

Depending on the nature of the goods, various government offices, such as Global Affairs Canada or the Canadian Food Inspection Agency (CFIA), may issue them.

The appropriate license ensures smooth shipment processing and helps avoid delays or penalties.

Do You Need an Import License in Canada?

The Canadian government does not impose an import license on every good. It is only required for certain controlled or restricted items.

Goods considered a threat to the health, safety, or environment and those covered by special trade agreements usually require an import license.

For instance, importing agricultural products such as meat, dairy, or plant products will likely require CFIA’s approval. Certain firearms, Pharmaceuticals, Hazardous materials, and licensed trade goods need licenses as well.

Cultural goods or those needing quota limits, such as textiles, might require these licenses too.

On the other hand, if your products are non-restricted and meet all regulatory standards in Canada, you probably won’t need an import license.

Nonetheless, it is important to observe the requirements set forth by the CBSA.

Commonly Controlled Goods Requiring Import Permits:

- Clothing and Textiles: Based upon material and origin.

- Dairy Products: Like cheese, milk and others.

- Meat and Animal Products: Includes processed meat products.

- Steel and Aluminum: Prone to quotas and trade agreement controls.

- Ammunition and Firearms: Subject to important regulations and restrictions.

- Some Chemicals and Pharmaceuticals are subject to safety controls.

You can easily find out whether you need an import license in Canada or not by simply going to this Import control list in Canada created by their government.

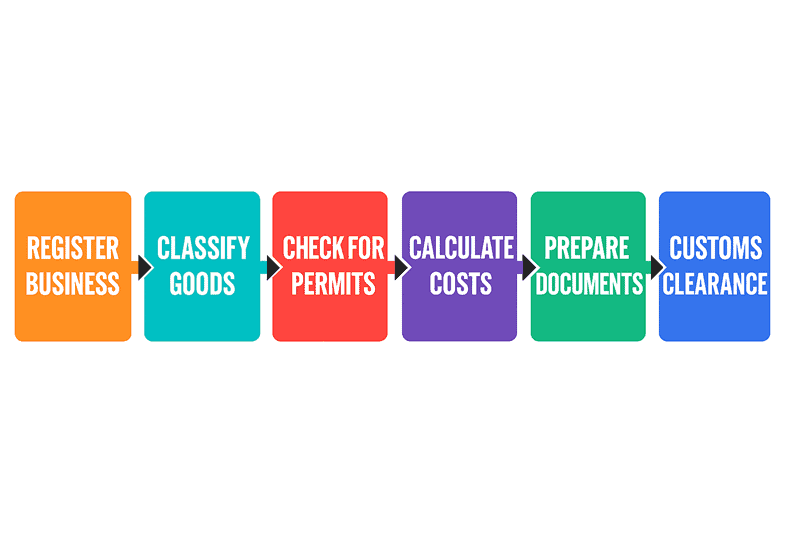

Step-by-Step Guide to Importing into Canada

International import/export is a complicated process. Everything will go smoothly if you have the right documents and follow all the rules implied by respective countries. But a slight mistake can make the process a nightmare.

At Winsky Freight, we have been helping people all over the world in this industry for over a decade. We created this step-by-step guide especially for importers from Canada. Read this thoroughly, especially if you are a newcommer in this industry.

Step 1: Register Your Business and Obtain a Business Number (BN)

To import goods, you must first register your business in Canada and obtain a Business Number (BN). The BN serves as your company’s number for all government interactions, for example, import declarations or tax activities.

Without a BN, you can’t open an Importer/Exporter account. You need this account to manage import duties, follow customs rules, and trade smoothly.

How to Get a Business Number

- Register Your Business

Choose if your business will be a sole proprietorship, partnership, or corporation. You may register either federally through the Government of Canada or locally through a province or territory, depending on your business structure. - Apply for a BN through the Canada Revenue Agency (CRA)

Visit the CRA Business Registration Online page or call their registration service. You can also apply by mail. You have to provide your business name, structure, and address. - Add an Import/Export Account to Your BN

After receiving your Business Number (BN), you have to request to add an Import/Export program account. You will. You use this account to deal with CBSA for customs clearance.

The steps are simple, and the business registration for a BN is usually done within a couple of days after the documents are provided.

Step 2: Identify and Classify Your Goods and Understand the HS Code

Before importing, the first thing is to assign the correct code for your product. It’s crucial for calculating duties and unnecessary customs delays.

What is the Harmonized System (HS) Code and Why Does it Matter?

You can’t just describe your product in plain terms like “wooden toys” or “kitchen equipment.” Instead, you must follow a Harmonized System (HS) code, which is part of a global classification system used in over 200 countries

The Harmonized System (HS) Code is the global standard that states the classification of traded products. This is a six-digit code that simplifies international trade.

Most countries use this system for its six digits as it simplifies international trade.

Here’s how to find the correct HS Code for your goods:

- Break down your product: Find out the materials, components, and function. Be very specific. For example, wool and cotton sweaters have different HS codes.

- Use the Canada Tariff Finder: Search by keyword (like “sweater”) and filter by material.

- Review the Customs Tariff: Check the official Canadian Customs Tariff document to get the specific HS code.

- Get expert help: If you are not sure then take expert help.

Step 3: Check for Permits and Regulations

You must first look into every category of goods that you can import into Canada.

There are two categories:

- Restriced/controlled

- Prohibited/banned.

Controlled products are those that can only be brought into Canada upon specific regulatory approval. For example, if you are importing hospital equipment, you might require a permit, an inspection, or a certificate.

Banned products are completely different. These products are outright restricted and cannot be imported under any circumstances.

Controlled Items You Need Permission to Import

| Goods | Reason for Classification |

|---|---|

| Firearms and ammunition | Requires permits for public safety. |

| Pharmaceuticals and medical devices | Must meet health and safety standards. |

| Agricultural products (e.g., seeds, plants, live animals) | Mitigates risks to local agriculture. |

| Chemicals and hazardous materials | Safe handling and environmental protection. |

| Cultural property (e.g., artifacts, historical items) | Preserves cultural heritage. |

| Live aquatic species | Protects ecosystems and biodiversity. |

| Controlled drugs and substances | Prevents abuse and requires permits. |

| Vehicles and vehicle parts | Must meet Canadian standards. |

| Food products (e.g., meat, dairy, nuts) | Food safety regulations. |

| Rare minerals and precious gems | Security, valuation, and regulation |

Goods You Can’t Import into Canada

| Goods | Reason for Classification |

|---|---|

| Obscene materials (e.g., hate propaganda, explicit exploitation content) | Violates moral and human rights standards. |

| Counterfeit currency and copyright-infringing items | Breaches intellectual property laws. |

| Hazardous materials (e.g., polychlorinated biphenyls – PCBs) | Prevents environmental risks. |

| Items made from endangered species (e.g., ivory, exotic furs) | Protects nature and follows agreements. |

| Pest-infested agricultural products | Safeguards agricultural biosecurity. |

| Used mattresses or bedding | Health and hygiene concerns. |

| Explosives and unauthorized fireworks | High safety risks |

| Unsafe or fake health products | Risks public health. |

| Restricted knives (e.g., switchblades, gravity knives) | Safety issue |

| Satellite signal decoding devices | Prevents unauthorized satellite programming access. |

We listed some of the top items. For a detailed list, please visit the Canada Border Services Agency (CBSA) website.

Step 4: Calculate Duties, Tariffs, and Taxes

Every imported product in Canada is subject to specific charges.

These include:

- Customs Duties: varies with HS code and origin. Certain countries have trade agreements with Canada that lower this rate.

- GST: Federal tax of 5% levied on the majority of goods.

- PST: Depends on the province. Some implement a separate PST, while others use a combined Harmonized Sales Tax.

- Excise Duties or Taxes: Applicable to alcohol, tobacco, and some fuel types.

- Brokerage and Handling Fees: Added by customs brokers or courier companies who manage your clearance.

Here’s an example to make the concept clear:

You import electronics worth $8,000 from China. The duty rate is 6%.

You’ll pay:

Duty: $480

GST (on $8,480): $424

Brokerage: $120

Your total cost becomes $9,024.

Ways to Reduce Import Costs in Canada

For businesses that deal with repeat imports, Canada has put in a couple of options to help better manage cost:

Duty Deferral Program: Permits postponing payment until goods are sold or moved into the Canadian market.

Drawback Program: You can apply for a duty refund if you either export the product again or use it in another product that will be exported.

Customs Bonded Warehouse: Goods can be kept in Canada, and duties are not payable upon import. Payment is remitted only when the goods are removed from the warehouse.

Step 5: Prepare Documentation for Customs Clearance

Essential Documents

Here are the essential documents you have to show to the Candadian customs authority:

- Bill of Lading

- Commercial Invoice

- Packing List

- Import Permits or Licenses

- Certificates of Origin (optional, but recommended for trade agreements)

- Canada Customs Declaration Form (B3)

- Insurance Documentation (optional, but highly recommended)

Expert Tips for Smooth Customs Clearance in Canada

- Check paperwork: Ensure all forms, codes, and values are accurate.

- Use a customs broker: They help with compliance and reduce errors.

- Classify goods correctly: Use proper HS codes to avoid delays.

- Declare full costs: Don’t undervalue or skip fees.

- Stay updated: Follow CBSA regulation changes.

- Track shipments: Use tracking tools to monitor progress.

- Prepare for inspections: Pack neatly and keep documents ready.

Step 6: Engage a Licensed Customs Broker (Optional)

Importing from another country is a complex process doesn’t matter where you are importing from.

There are sets of rules for every step. Moreover, all rules are not the same for all countries. That’s why you need expert help.

If you are importing for the first time, then it’s a must; otherwise, you can face many problems.

Why Use a Customs Broker?

Customs brokers are licensed experts who handle import rules and paperwork.

Their help is very helpful for people who have just started the importing business or those trying to import complex products that need special permits, classification, or elaborate detailing.

They can help you with

- Classification using the Harmonized System (HS) codes. They guarantee the correct use of the HS code.

- Accurate calculations of duties, taxes, and various additional fees.

- Documentation preparation and submission of CBSA.

- Ensure compliance with all applicable regulations.

- Address and offer instant solutions for issues that may arise during the import process.

How to Find a Licensed Customs Broker in Canada?

Finding the right customs broker requires some research and careful consideration. A good customs broker will have industry experience, a solid reputation, and an understanding of your specific business needs.

Tips to find a licensed customs broker:

- Always start the search with the list of customs brokers the CBSA has listed.

- Check on their websites for reviews and request the customs broker for client references.

- Be sure to ask whether they deal with your specific industry or goods of interest.

- Look for referrals from colleagues in trade or professional bodies.

- Set upfront discussions about their service charges and the scope of services they provide.

- Ask them for online tools or platforms they offer for tracking shipments.

Special Considerations for Importing

Importing into Canada isn’t always straightforward. Some goods come with extra rules, and it’s essential to understand them. Knowing the rules helps you avoid delays, fines, or, in the worst case, being rejected.

Food and Agricultural Products

If looking to import food or agricultural products, be ready for obstacles. These goods must pass through demanding safety and quality standards.

There may also be special permits and inspections needed, as well as restrictions to prevent potential disease or pest invasions. Always check these guidelines as early as possible.

Labelling and Packaging Rules

All items in the nation require proper labels, which must contain an ingredient list or safety warning when necessary, and is written in both English and French.

There are also quality and safety standards for packaging. Correct labeling and packing can save you from compliance issues later.

Trade Agreements and Duty-Free Imports

Did you know trade agreements can be a big win for importers? CUSMA (formerly NAFTA) lets you import certain goods duty-free or at a reduced rate if they fall below a specific cost.

As long as your goods meet the requirements, you stand to save significantly on costs.

Know the steps? Start trading now

Now you know how to get an import license in Canada and what steps to follow.

Each step, from registering your business to customs, is crucial. With the proper documents, you can avoid delays, unplanned costs, or several inspections.

Now, you can proceed with confidence, whether your plans involve small shipments or larger logistics.

Want expert assistance? Let us help you get simple, step-by-step instructions designed specifically for your business. Send us a message and we would contact you soon.

Leave A Comment