Customs Clearance Meaning & Process & Tips

Customs is a major challenge for businesses importing from China. Delays, unexpected fees, and complex paperwork can turn shipments costly and complicated.

Delays, fees, and paperwork can make shipments costly and complicated.

In 2023, the USA imported from China over 400 billion dollars worth of goods, meaning that it is still the largest trading partner of the USA, which is 2.8% higher than the previous year. (source: US FACTS).

However, the global trade landscape has been volatile since President Trump’s administration, with shifts in tariffs, trade policies, and customs regulations creating uncertainty for businesses. And it will certainly take time to settle things down.

Therefore, we have prepared some tips and tricks along with an updated process and meaning for customs clearance.

1. What Is Customs Clearance and Why Does It Matter?

Customs clearance makes sure the imported products are legal and meet all the regulatory requirements.

You have to submit all the documents, payment of duties and taxes, and an approval authorization from the customs offices. Without customs clearance, authorities may delay, seize, or reject shipments.

Here’s why it matters:

- Avoiding Costly Delays – Shipment documents which may not be accurate or missing data can cause shipment delays at ports.

- Saves Money – Reasonable taxes and duties can be set by proper classification of goods which avoids overpayment.

- Ensures Legal Compliance – There are specific regulatory policies around certain imports such as electronics and textiles which, if not followed, could incur a fine or confiscated product.

- Smooth Flow Business Operations – Disruptions in the supply chain are greatly reduced and help customers to get deliveries much quicker.

Read More: Regarding to Amazon shipment customs clearance, how can you do it? How can we pay duty and tax?

2. Who Takes Part in Customs Clearance?

A variety of people work together to ensure that clearances are done smoothly. Here are the major ones:

Importer/Exporter (Mandatory)

The person or entity with whom a contract is performed. They need to submit appropriate papers and pay the required duties.

Customs Broker (Optional but Recommended)

A qualified person who acts as a middleman with the importer/exporter and customs authorities. They deal with the documentation, policies, and progress of the procedure. While not always a requirement, a broker does make complex clearances easier.

Customs Authorities (Mandatory)

Customs law offices (like U.S. Customs and Border Protection) that manage the guarantee of legislation pertaining to international affairs and surveillance of goods and services under exchange, incurring rates, taxes, and duties. All items that are shipped are obliged to go through customs control.

Freight Forwarder (Optional)

A company that supplies a service forwarder, which arranges import or export shipment in international and domestic traffic. Though you can handle that without a forwarder, they make the shipment process easy and save money. Most freight forwarders have a customs clearance department.

Carrier (Mandatory)

The company that provides shipping services, such as an airline, shipping line, or trucking company. They have the goods and are to deliver them. The carrier is indispensable as goods cannot reach their intended destinations without a carrier.

Providers of Warehouse/Storage (Category-Specific)

Facilities for temporary storage of goods during customs clearance, especially during inspection or delays, necessary before delivery.

Government Regulatory Agencies (Category-Specific)

Some government bodies respond to particular types of goods, and also impose regulations. These agencies are dictated by the type of the shipment:

Food and Drug Agencies (FDA, FSIS) – used with food, drinks, and drugs.

Different authorities that manage different types of commodities have formed additional regulation divisions. It is dependent on the type of shipment recommended:

- Agencies dealing with food and drugs (For instance, FDA, FSIS) – Has jurisdiction over food, drinks, and pharmaceuticals.

- Environmental agencies (For instance, EPA) – Responsible for chemicals, dangerous products, and products that are harmful to the environment.

- Health and Safety Agencies – Accountable for surgical instruments and health items.

- Agriculture departments – With jurisdiction over plants, seeds, and products from animals.

Such items cannot be cleared without being checked and approved by the necessary regulatory body.

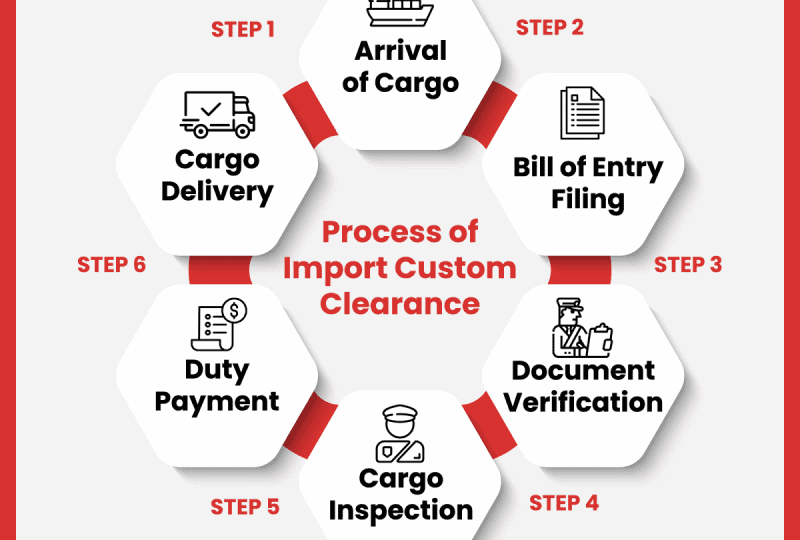

3. Breaking Down the Customs Clearance Process: Who Does What?

Customs clearance has key steps that are necessary for the legal and efficient movement of goods across borders. Here is a more straightforward approach to the structure:

Step 1: Preparing for Import or Export

Key documents include:

- Commercial Invoice

Details the value, quantity, and description of the goods.

- Packing List

Lists the contents of each shipment package for verification.

- Bill of Lading

Proof of the carrier’s receipt of goods and shipping terms.

- Customs Declaration Forms

Provides necessary details like shipment value and origin.

- Certificate of Origin

Certifies where the goods were manufactured, which affects duties.

Step 3: Submitting Documents to Customs Authorities

Send all required documents to customs authorities for review. Any mistakes here can land you in trouble. Therefore, hiring a local custom broker to complete this process for you is the best way. It will save you additional charge and the most important thing in import business – “time.”

Step 4: Customs Inspection and Duty Calculation

Authorities in customs may evaluate the shipment for compliance. Duties are calculated using factors including item value and the country of origin.

- Delivered Duty Paid (DDP) means that duties and taxes are pre-paid by the seller.

- Duty Unpaid (DDU) denotes that the receiver will pay after the product reaches.

Step 5: Cargo Release and Final Delivery

After the payment of other fees and passing the inspection, customs releases the goods. The goods are then shipped to the requested final point. Every detail needs attention, but in ideal situations customs clearance is easy.

4. How Customs Clearance Rules Vary by Country

Countries vary widely on customs clearance rules, which also differs in documentation, time to pay taxes and duties, and processing costs. Here’s a breakdown of key variations:

Differences in Required Documentation

- United States: Requires a Commercial Invoice, Bill of Lading, and Importer Security Filing (ISF). Recent policy changes have increased scrutiny on imports from China, necessitating additional documentation to ensure compliance with heightened tariffs and trade restrictions. time.com

Who makes this decision? – The Customs and Border Protection (CBP) along with other federal entities devise these rules in relation to national trade laws and security policies in the international system.

- European Union: Required to have a Single Administrative Document (SAD) and a Certificate of Origin. The EU plans to bolster customs enforcement on parcels coming from Chinese merchants like Shein and Temu due to an overflow of dangerous and fake products. There are proposals of withdrawing the exemption from customs duty for parcels which are below €150, which will hurt the import of low value goods.

Who makes this decision? – The European Commission and customs authorities of member states.

- China: Additional documents such as the China Compulsory Certification (CCC) are sometimes requested for different products. In response to tariffs placed by the United States, China has set forth its own tariffs and export controls which affect the documentation of certain imports and exports.

Who makes this decision? – As per the national regulations, the General Administration of Customs of China (GACC) makes these decisions.

- India: Requires a Bill of Entry and the registration of Goods and Services Tax (GST) under their jurisdiction. There is a new shift in policy, which is an effort to modernize the process of customs clearance to promote international trade.

Who makes this decision? – The Central Board of Indirect Taxes and Customs (CBIC) manages these requirements under the national tax legislation.

Tax and Duty Variations Worldwide

- United States: This country implements duties under the Harmonized Tariff Schedule (HTS) which varies between 0% to 37.5%. The most recent increases include an additional 20 percentage points to the current tariffs on imports from China. reuters.com

- European Union: Value Added Tax (VAT) is charged, usually between 17% and 27%.. This group is considering ending the customs duty exemption, currently set at €150. It may impact imports of lower value.

- China: Duties differ greatly, with some goods having anti-dumping or countervailing duties applied. In response to the US tariffs, China has placed some additional duties on US goods and agricultural products. (Source: Wiki)

- India: Integrated GST (IGST) and Basic Customs Duty (BCD) are imposed and each rate is different depending on the product category. New developments have broadened attempts to simplify the tax structure for enhancing trade. (Source: Wiki)

Editor’s Note: These rules vary by country. Make sure you understand the regulations of the destination country before importing. If you are importing from China, check whether any special trade agreements or contracts exist between the two countries. Customs brokers or freight forwarders can provide accurate and updated information.

Processing Times and Customs Efficiency

- United States: Noted for their processing efficiency since the majority of the shipments are cleared in 24 to 48 hours. However, Chinese goods are facing increased scrutiny due to recent tariffs, which could result in delays.

- European Union: There are variations in processing time per country, although the Northern European countries tend to be quicker. Increased scrutiny on imports from Chinese e-commerce platforms can cause heightened clearance delays.

- China: As a result of effective inspections, customs tends to be slower for high value or restricted commodities. The recent trade tensions with China have resulted in increased scrutiny of US gifts.

- India: Primarily, India is behind because of their manual processes and shipment backlogs. There is an ongoing effort to make processes more automated and increase speed and efficiency.

Who makes this decision? – Customs and border control agencies are responsible for processing times. These depend on security levels, the number of inspections, and available resources.

Impact of Recent U.S. Trade Policies on China

On February 4, 2025, President Trump imposed a 10% tariff on nearly all goods from China, which was increased to 20% on March 4.

In response, China placed a 15% tariff on U.S. coal and LNG imports and 10% on crude oil, machinery, and certain vehicles.

China also launched an investigation into Google for potential Antitrust Law violations and restricted the export of rare metals like tungsten, requiring export licenses.

5. Common Challenges in Customs Clearance

- Holds and fines are the results of missing or inaccurate paperwork. All documents need to be cross-checked for consistency.

- Incorrect HTS codes result in customs rejection or higher fees. gcode classification must be confirmed.

- Unforeseen expenses like brokerage and anti-dumping charges elevate costs. Be proactive and clarify costs beforehand for these charges.

- Permits that are not available, value that is too low, or labels that are inaccurate lead to waste of time. Compliance must be realistically ensured.

- Tariff and trade changes affect foreign goods coming in. Be informative.

- Further, uncontrolled shipments call for extra documentation. Make sure to confirm the information before the export to make sure these documents.

- Inaccurate Declaration leads to scrutiny, which is usually associated with higher prices. Always declare the reasonable worth of the goods.

- Unsatisfactory shipment packaging could lead to damages or even a complete rejection. Adhere to the outlined packaging requirements.

- Storage expenses increase as a result of port delays stemming from congestion, strike action, or other unforeseen shutdowns. Be prepared for delays.

- Customs rejections are the result of incomplete or incorrect country of origin labeling. Ensure that the labels are correctly filled.

6. Practical Tips for Smooth Customs Clearance

Hiring a Licensed Customs Broker

A licensed customs broker makes sure everything from the paperwork to the duties is correct, and hugs a lot of red tape. It is their responsibility to keep track of changing trade laws, which makes clearing customs much more convenient and prevents delays along with other unexpected costs.

Using Technology to Streamline the Process

Customs documents, shipments, and any potential mistakes that come with them can be managed and automated by digital tools. For some documents, automation is possible with the following:

- Filings with customs using EDI( Electronic Data Interchange) are done in real time.

- Imports to the USA using Automated Commercial Environment(ACE).

- Customs clearance software that works with other transport agencies and forwarders.

Avoiding Costly Mistakes and Delays

Here are some common mistakes that we observed. Double check these so that you don’t make any of these”

- Proof documents twice before filing errors with the correct documents.

- Be certain that your HTS codes are accurate because if they aren’t, you might be forced to pay extra penalties or duties.

- Understand DDP DDU incoterms.

- Always be informed about policies regarding trade and follow the regulations for compliance.

Building Strong Relationships with Logistics Partners

A good freight forwarder or shipping carrier makes sure that shipments clear customs without any delays. Strong relationships with logistics providers help with:

- Faster resolution of problems when customs holds are an issue.

- Providing importers with accurate shipment tracking.

- Compliance and documentation expert advice.

7. FAQs

1)Can I Handle Customs Clearance Myself?

Yes, but it is very difficult and time consuming. Using a licensed customs broker will ease the process.

2)How Can I Avoid Customs Delays?

You may avoid delays by ensuring proper documentation, proper classification of goods, and being informed on relevant policies.

3)What Are the Penalties for Non-Compliance?

Penalties can include fines, shipment delays, or loss of goods. There are many risks, so it’s crucial to follow customs rules.

Conclusion

The right customs clearance is the most critical part in shipping. Any error, no matter how small, can completely harm your shipment.

At Winsky freight, we have a dedicated customs clearance team to help our clients. Also, we have connections with thousands of customs brokers globally.

Contact us any time for assistance with imports or exports. Call us or fill out the contact form. One of our experts will contact you ASAP. You can get free consultancy support from us.

Leave A Comment